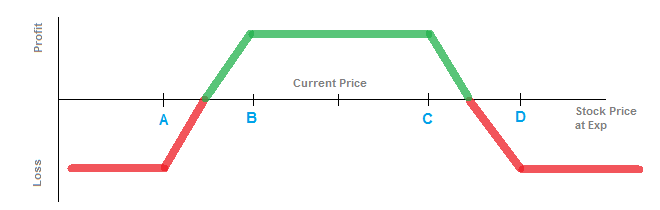

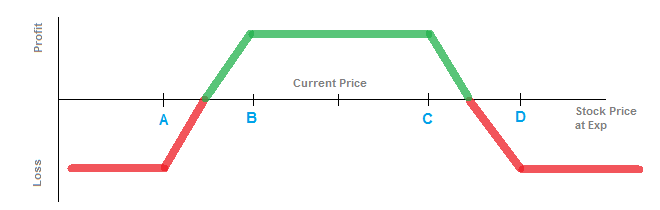

Sample Payout Diagram

Legs

- Buy Put, Strike A

- Sell Put, Strike B

- Sell Call, Strike C

- Buy Call, Strike D

Strategy Description

An Iron Condor is made up of 4 options on 4 separate strikes for the expiration. It is very similar to the Iron Butterfly

strategy, with the difference being that the butterfly sells the inner options at the same strike, and the condor sells them at different strikes.

You can imagine it as selling a nearly-at-the-money put and a nearly-at-the-money call to collect options premium from the sale,

while buying an out-of-the-money put and an out-of-the-money call to limit your risk if the stock moves a great deal in either direction.

It is very much like selling a Strangle on strikes close to the at-the-money spot price,

and buying a strangle on strikes further out at the same time.

In the diagram above, you'd be selling the inner put at strike B, selling the inner call at strike C, and buying the out-of-the-money put a strike A

and an out-of-the-money call at strike D. The distance from strike A to strike B is the same distance as strike C to strike D.

An Example

Imagine a stock with a current price of $100. You sell the $95 strike put and the $105 strike call to collect premium. You would be exposed to significant risk if the stock

moves outside those prices. To limit the risk, you buy the $90 strike put and the $110 strike call, effectively stopping your risk in either direction at those points.

The two outer options are much further out-of-the-money than the two inner ones, so as a whole you'd be collecting a net premium at the time of the trade. It's like

selling a credit put spread and a credit call spread simultaneously.

When to Use It

An Iron Condor strategy is used most effectively when you are expecting very little stock price movement away from the current at-the-money spot, but you want

to establish an accepted risk. Depending on how wide the strikes are and how expensive the options are, you can establish the trade for a higher risk and higher reward,

or for lower risk and lower reward. Unlike an Iron Butterfly, with an Iron Condor you can widen the range at which you'd receive your maximum payout.

Break-Even Points at Expiration

The strategy has 2 separate break-even points, one to the downside and one to the upside. Since you're selling the higher premium put at strike B,

as the stock price moves below that value, it will cost you more to buy the option back. So the break-even point to the downside is equal to the

strike price B minus the amount that you sold the strategy for (the initial premium collected). The break-even point to the upside is equal to

strike price C plus the initial premium collected.

For example, if you sold the $90 - $95 - $105 - $110 iron condor for a $2 net premium, then your break-even points at expiration would be $93 and $107. To

profit on the transaction, the price would have to remain between $93 and $107.

Max Gain

The maximum possible gain is the net credit you receive when initially selling the strategy. If the stock price at expiration is anywhere between strike B

and strike C, then all four options expire worthless and you get to keep all the initial premium from the sale.

Max Loss

Your maxmium risk is limited to the distance between strike price A and strike price B (or between strike C and D, as they should be equal),

less any net credit you received for selling the strategy.

In the example we've been using ($90 - $95 - $105 - $110), the distance between the outer strikes and the inner strikes is $5. If the initial credit was $2,

then your maximum loss would be $3. The maximum loss would be realized if the stock price at expiration was $90 or less, or if it was $110 or greater.