Analysts Agree- Cobalt 27 Share Price Disconnected from Underlying Valuation; EV Adoption Worldwide Stronger Than Ever

ACCESSWIRE 7-Nov-2018 7:44 AM

TORONTO, ON / ACCESSWIRE / November 7, 2018 / New research reports out of TD Securities Inc. and BMO Capital Markets point out significant valuation disconnects in the current share price of Cobalt 27 Capital Corp. (OTC:CBLLF) even as EV sales break new records.

Coming on the heels of a recent increase in its credit facility to US $200 million, Cobalt 27 is now positioned to close its previously announced acquisitionof the world's first producing cobalt-nickel stream on the world-class Ramu mine. Upon completion, the Company will begin to see immediate cash flows on a long-life asset that is is expected to result in attributable stream production totaling approximately 700,000 pounds of cobalt and 3 million pounds of nickel annually.

TD Securities research analyst Craig Hutchinson believes that proceeds from Ramu could be used to support a 1-2% dividend yield based on the research firm's current price target for Cobalt 27 while also allowing the company to commence a share buyback program. In a recent report, the analyst noted that the combined Ramu streams could generate C$33 million of cash flow for Cobalt 27 in 2019 alone. TD Securities has a buy recommendation on the Company.

In a recent flash alert issued by BMO Capital Markets, analyst Andrew Mikitchook said that closing of the Ramu transaction should represent an important catalyst for Cobalt 27 shareholders. The analyst said he expects the Ramu transaction to close before year end and also pointed out that ''Cobalt 27 will pay ongoing payments of $4 and $1 per pound of cobalt and nickel leaving significant cash-flows attributable to the company at current spot prices.'' BMO Capital Markets has an outperform rating on shares of Cobalt 27.

Analysts concur that the Company's valuation disconnect from current pricing and long-term cobalt fundamentals make shares of Cobalt 27 compelling at these levels. As Hutchison pointed out, record sales numbers from Tesla (NASDAQ:TSLA) in Q3 ''demonstrate the high adoption rate of EVs, which bodes well for the battery metals space and cobalt prices going forward, in our view.''

Electric VehicleSales Continue to Surge:

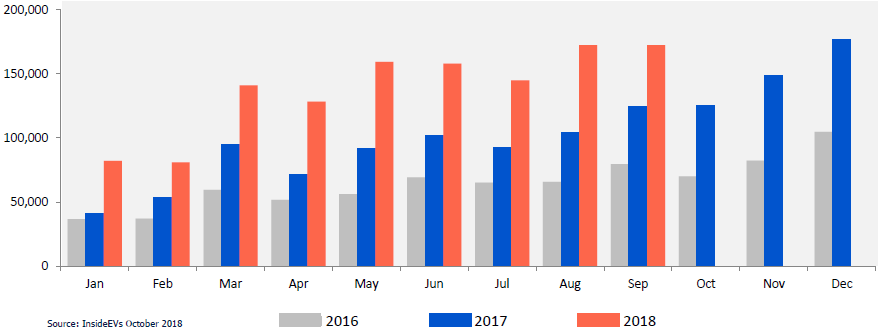

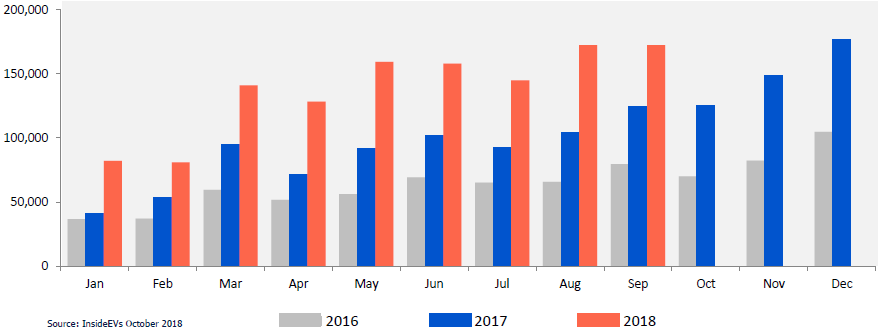

Continued growth in EV sales suggest that demand for battery metals, such as a cobalt and nickel, will remain on an upward trajectory for the foreseeable future. In fact, worldwide sales of EVs continue to break new records with each passing month. Through the first eight months of 2018 cumulative sales of EVs are up 69% year-over-year.

Figure 1. Electric Vehicle Sales Worldwide (Monthly)

Cobalt 27's exposure to battery metals, such as nickel and cobalt, combined with the potential for a dividend and share buyback in the near term, suggest that its share price remains highly disconnected from its underlying valuation.

Cautionary Statement:

JuniorMining Network (''JMN'') is not a financial advisory or advisor, investmentadvisor or broker-dealer and does not undertake any activities that wouldrequire such registration. The information contained herein is not intended tobe used as the basis for investment decisions and should not be considered asinvestment advice or a recommendation, nor is the information an offer orsolicitation to buy, hold or sell any security. JMN does not represent orwarrant that the information posted is accurate, unbiased or complete and makeno representations as to the completeness or timeless of the material provided.JMN receives fees for producing content on financial news and has beencompensated US$750 by Cobalt 27 Capital Corp. to publish this report. Investorsshould consult with an investment advisor, tax and legal consultant beforemaking any investment decisions. All materials are subject to change withoutnotice.

Contact:

Junior Mining Network

www.juniorminingnetwork.com

SOURCE: Junior Mining Network