Student Debt Removes Embarrassment for Young Americans Moving Back Home... For Years

Business Wire 6-Jun-2019 8:30 AM

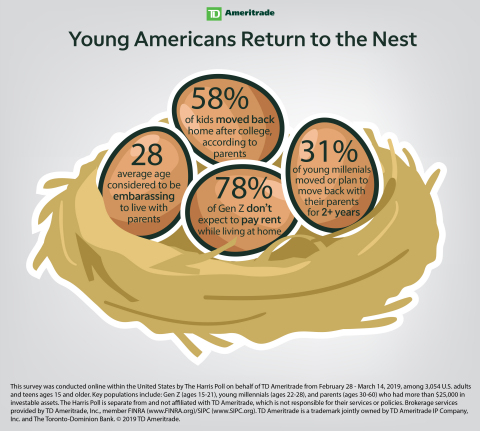

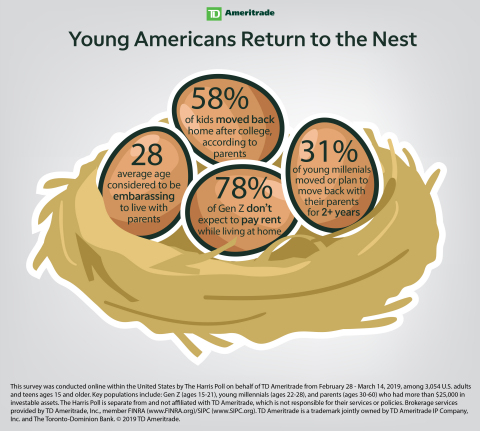

Living at home with parents doesn't become embarrassing until age 28,

survey for TD Ameritrade reveals

As student debt1 and housing prices continue to rise2,

more and more young adults are looking to save money by living with

their parents longer. Luckily for them, according to a

new survey conducted by The Harris Poll on behalf of TD Ameritrade,

both young adults and parents agree that living with one's parents

doesn't become embarrassing until age 28, on average.

This press release features multimedia. View the full release here:

https://www.businesswire.com/news/home/20190606005051/en/

Young Americans Return to the Nest (Graphic: TD Ameritrade)

"Shouldering more than $1.5 trillion in U.S. student loan debt1,

it's no surprise that young adults are looking for ways to save money as

they focus on building a career foundation," said Christine Russell,

senior manager of retirement and annuities at TD Ameritrade. "You don't

become an adult the day you graduate from college – it's a process that

takes time. And while there's nothing wrong with getting support from

your parents, it's important for both parties to set rules and

communicate during that process."

Student debt is delaying adult milestonesStudent debt has

caused nearly one in three young millennials to delay moving out of

their parents' home, along with delaying other milestones:

-

Buying a home: 47%

-

Saving for retirement: 40%

-

Moving out of parent(s)' home: 31%

-

Getting married/civil ceremony: 21%

-

Having children: 21%

For those moving back in with their parents, the stint will likely be

rent-free and not a quick stop

-

Half (50%) of young millennials who are currently enrolled in college

or who intend to go to college plan to move back home after, and 82%

of parents say they would welcome their children moving back home

after college.

-

When moving back in with their parents, it's not just a short-term

stop: one in three (31%) young millennials move back for two years or

more, with more than half (56%) saying their return home will last at

least a year or longer.

-

For many, this time will be rent-free, with 38% of young

millennials expecting to pay rent while living at home.

-

For those young millennials who do expect to pay rent while living

at home, the average is $486 a month.

Expectations for an empty nest

-

The average age that parent respondents expect to become an empty

nester is 49, and most are looking forward to the experience: 60% of

parents agreed that being an empty nester will be more exciting than

depressing.

-

There's a significant difference between genders when it comes to

being excited about children moving out (70% of men, versus 53% of

women).

-

Empty nesters plan to prioritize travel (65%), new passions/hobbies

(40%) and retirement savings (40%) when their children move out.

Today's young adults plan to pay it forward

-

While some parents may need to help support their children for longer

than previous generations, the vast majority (81%) of Gen Z and young

millennials expect to help support their parent(s) financially and/or

provide housing for them in their older age.

"Young adults moving back home for more than two years can definitely

have an impact on parents' finances," said Russell. "And while it's

heartening to see that these young adults are willing to take care of

their parents in their time of need, the parents should take a close

look at how their adult child moving home will affect their finances and

retirement, and plan accordingly."

Russell highlights some advice for "boomerang generation" students and

their parents:

-

For students, try to think of the time you live with your parents as

your "gap year" – do what you can to contribute to rent and bills

(parents can use that money to contribute to retirement), get a head

start on paying off your student loans, and start building your credit.

-

Parents of children moving back home should be financially transparent

and involve them in conversations about financial planning. Talk to

them about your own journey to financial independence, discuss your

financial successes and your mistakes, and include them in budget

conversations, so they're aware of the day-to-day expenses of running

a household.

About TD Ameritrade Holding CorporationTD Ameritrade

provides investing

services and education to

more than 11 million client accounts totaling approximately $1.3

trillion in assets, and custodial

services to more than 7,000 registered investment advisors. We are a

leader in U.S. retail trading, executing an average of approximately

850,000 trades per day for our clients, more than a quarter of which

come from mobile devices. We have a proud history

of innovation, dating back to our start in 1975, and today our team

of 10,000-strong is committed to carrying it forward. Together, we are

leveraging the latest in cutting edge technologies and one-on-one client

care to transform lives, and investing, for the better. Learn more by

visiting TD Ameritrade's newsroom at www.amtd.com,

or read our stories at Fresh

Accounts.

Brokerage services provided by TD Ameritrade, Inc., member FINRA (www.FINRA.org)

/ SIPC (www.SIPC.org)

Source: TD Ameritrade Holding Corporation

About The Harris PollThe Harris Poll is one of the

longest-running surveys in the U.S., tracking public opinion,

motivations and social sentiment since 1963. It is now part of Harris

Insights & Analytics, a global consulting and market research firm that

strives to reveal the authentic values of modern society to inspire

leaders to create a better tomorrow. We work with clients in three

primary areas; building twenty-first-century corporate reputation,

crafting brand strategy and performance tracking, and earning organic

media through public relations research. Our mission is to provide

insights and advisory to help leaders make the best decisions possible.

TD Ameritrade is separate from and not affiliated with the Harris Poll,

and is not responsible for their services or policies.

Survey MethodologyThis survey was conducted online within

the United States by The Harris Poll on behalf of TD Ameritrade from

February 28 to March 14, 2019, among 3,054 U.S. adults and teens ages 15

and older. Key populations include: Gen Zs (n=1027, ages 15 to 21),

young millennials (n=1026, ages 22 to 28) and parents (n=1001, ages 30

to 60). The parents had more than $25,000 in investable assets.

1 https://www.federalreserve.gov/releases/g19/current/default.htm2

https://www.reuters.com/article/us-usa-property-poll/u-s-house-prices-to-rise-at-twice-the-speed-of-inflation-and-pay-reuters-poll-idUSKCN1J20G3

View source version on businesswire.com: https://www.businesswire.com/news/home/20190606005051/en/