SSR Mining Acquires 8,900 Hectares Contiguous to Marigold Mine

PRNewswire 27-Jun-2019 7:15 AM

VANCOUVER, June 27, 2019 /PRNewswire/ - SSR Mining Inc. (NASDAQ:SSRM) (TSX:SSRM) ("SSR Mining") is pleased to announce it has acquired approximately 8,900 hectares contiguous to the Marigold mine in Nevada, U.S. comprised of a 100% interest in the Trenton Canyon and Buffalo Valley properties (the "Properties") from Newmont Goldcorp Corporation (NYSE:NEM) (TSX:NGT) ("Newmont") and Fairmile Gold Mining, Inc ("Fairmile") for an aggregate purchase price of $22 million in cash and the grant to Newmont of a 0.5% net smelter returns ("NSR") royalty on each of the Properties, and the assumption of the long-term environmental and reclamation obligations for the Properties.

Transaction and Property Highlights

- Acquisition of a large, wholly-owned prospective land package with 340,000 ounces of historical gold production, contiguous to the southern boundary of the Marigold mine.

- Historical Indicated Mineral Resources estimate of 418,000 ounces of gold at Buffalo Valley.

- Increases Marigold's land position on trend with the Mackay pit to 19,800 hectares in Nevada's Battle Mountain - Eureka gold belt, an 84% increase.

- Planned exploration activities aim to further define and potentially increase Mineral Resources at the Properties.

- With exploration success, potential exists to enhance the current Marigold mine plan to extend mine life, increase production or improve margins.

- Increases land position, which is favorable to host oxide and additional deep sulphide exploration targets.

- Also in 2018 and 2019, consolidated four additional parcels totaling 130 hectares of land located within the Marigold mine land package.

Paul Benson, President and CEO said, "Acquiring the Trenton Canyon and Buffalo Valley properties is expected to increase our gold resources and add multiple zones of mineralization proximate to our Marigold mine infrastructure. The acquisitions increase our land position by 84% since acquiring the Marigold mine and the Valmy property. Exploration plans aim to upgrade and expand known gold mineralization to potentially extend mine life, increase operating flexibility or access higher margin tonnes. We expect to commence exploration activities in the near-term and to begin incorporating the Properties into our longer-term mine planning as we evaluate opportunities to continue creating value at Marigold for our shareholders."

Overview of the Properties

The Properties comprise an 8,900-hectare land package to the south and contiguous with the Marigold mine. The addition of the Properties increases our total land holding at the Marigold mine to 19,800 hectares.

The Trenton Canyon property consists of 7,350 hectares located immediately south and along the mineralized trend from the Marigold mine. The property was previously operated as an open-pit run-of-mine heap leach operation from 1996 to 2001. Based on data provided by Newmont, production during this period totaled approximately 290,000 ounces of gold from the North Peak, West and South pits within the Trenton Canyon property. The property also includes the North Peak heap leach pads and processing facilities. The Trenton Canyon property was previously 100% owned by Newmont.

The Buffalo Valley property consists of 1,550 hectares located southwest of the Marigold mine. The historic Indicated Mineral Resources estimate for Buffalo Valley is 418,000 ounces of gold (20 million tonnes at an average gold grade of 0.65 g/t), as of December 31, 20181. Such Mineral Resources estimate was prepared by Newmont and reported in its press release dated February 21, 2019, and is based on Newmont data (including collar, survey, lithology and assay data), using ordinary kriging with appropriate estimation parameters in accordance with industry standards. Such estimate needs to be verified by SSR Mining by conducting detailed verification checks, including QA/QC of location, geological, density and assay data. A qualified person for SSR Mining has not done sufficient work to classify the historical estimate at Buffalo Valley as current Mineral Resources and therefore SSR Mining is not treating the historical estimate as current Mineral Resources. Based on data provided by Newmont, historical production at Buffalo Valley from 1989 to 1991 totaled approximately 50,000 ounces of gold. Buffalo Valley was previously operated as a joint venture between Newmont (70% ownership and operator) and Fairmile (30% ownership).

Historical exploration activities on the Properties consist of over 2,700 drill holes totaling more than 340,000 meters of drilling completed between 1980 and 2012. The Properties host the same rock formations present at the Marigold mine, while displaying a higher intensity of rock alteration. Historic drilling indicates the prospective mineralized corridor at Trenton Canyon extends for at least 3,000 meters in a north-south direction, while surface geochemical anomalies potentially extend the mineralized footprint for over 5,000 meters. Our exploration activities are expected to commence in the near-term and will initially target Mineral Resources definition and confirmation.

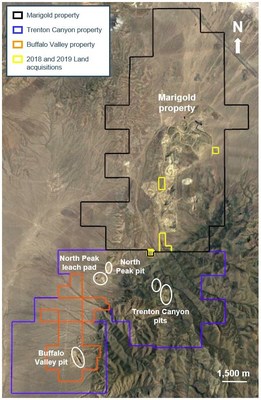

See Figure 1 for a map of the Properties and the current Marigold mine. This figure also shows four additional land parcels acquired in 2018 and 2019, which have the potential for additional mineralization or infrastructure benefits.

Transaction Overview

Under the terms of the purchase agreements entered into with Newmont and Fairmile, we have acquired Newmont's and Fairmile's respective interest in the Properties for aggregate cash consideration of $22 million plus the grant to Newmont of a 0.5% NSR royalty on all mineral production from each of the Properties. The purchase price was funded from cash on hand. Under the terms of the purchase agreements, we have provided financial assurances to the environmental regulatory authorities with respect to the Properties' long-term environmental and reclamation obligations totaling approximately $23.1 million.

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Mineral Resources disclosed by Newmont have been grossed up to illustrate 100% SSR Mining ownership of Buffalo Valley and are subject to rounding. Metal price used for Mineral Resources estimate is $1,400 per ounce of gold. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

|

Figure 1: Location of the Trenton Canyon, Buffalo Valley and Marigold properties in Nevada, U.S.

Qualified Persons

The scientific and technical data contained in this news release has been reviewed and approved by Karthik Rathnam, MAusIMM (CP) and James Carver, a SME Registered Member, each of whom is a qualified person under National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). Mr. Rathnam and Mr. Carver are employed at the Marigold mine as Resource Manager, Corporate and Chief Geologist, respectively.

About SSR Mining

SSR Mining Inc. is a Canadian-based precious metals producer with three operations, including the Marigold mine in Nevada, U.S., the Seabee Gold Operation in Saskatchewan, Canada and the 75%-owned and operated Puna Operations joint venture in Jujuy, Argentina. We also have two feasibility stage projects and a portfolio of exploration properties in North and South America. We are committed to delivering safe production through relentless emphasis on Operational Excellence. We are also focused on growing production and Mineral Reserves through the exploration and acquisition of assets for accretive growth, while maintaining financial strength.

For further information contact:

W. John DeCooman, Jr.

Senior Vice President, Business Development and Strategy

SSR Mining Inc.

Vancouver, BC

Toll free: +1 (888) 338-0046

All others: +1 (604) 689-3846

E-Mail: invest@ssrmining.com

To receive SSR Mining's news releases by e-mail, please register using the SSR Mining website at www.ssrmining.com.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking information within the meaning of Canadian securities laws and forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements") concerning the anticipated developments in our operations in future periods, and other events or conditions that may occur or exist in the future. All statements, other than statements of historical fact, are forward-looking statements.

Generally, forward-looking statements can be identified by the use of words or phrases such as "expects," "anticipates," "plans," "projects," "estimates," "assumes," "intends," "strategy," "goals," "objectives," "potential," or variations thereof, or stating that certain actions, events or results "may," "could," "would," "might" or "will" be taken, occur or be achieved, or the negative of any of these terms or similar expressions. The forward-looking statements in this news release relate to, among other things: our ability to discover and increase Mineral Resources at the Properties and the Marigold mine; the potential to enhance the current Marigold mine plan to extend mine life, increase production or improve margins; expected timing for commencement of exploration activities on the Properties; future production of gold, silver and other metals; Mineral Resources estimates; estimated production rates for gold, silver and other metals produced by us; ongoing or future development plans and capital replacement, improvement or remediation programs; and our plans and expectations for our properties and operations.

These forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied, including, without limitation, the following: uncertainty of production, development plans and cost estimates for the Marigold mine, the Seabee Gold Operation, Puna Operations and our projects; our ability to replace Mineral Reserves; commodity price fluctuations; political or economic instability and unexpected regulatory changes; currency fluctuations; the possibility of future losses; general economic conditions; counterparty and market risks related to the sale of our concentrates and metals; uncertainty in the accuracy of Mineral Reserves and Mineral Resources estimates and in our ability to extract mineralization profitably; differences in U.S. and Canadian practices for reporting Mineral Reserves and Mineral Resources; lack of suitable infrastructure or damage to existing infrastructure; future development risks, including start-up delays and cost overruns; our ability to obtain adequate financing for further exploration and development programs and opportunities; uncertainty in acquiring additional commercially mineable mineral rights; delays in obtaining or failure to obtain governmental permits, or non-compliance with our permits; our ability to attract and retain qualified personnel and management; the impact of governmental regulations, including health, safety and environmental regulations, including increased costs and restrictions on operations due to compliance with such regulations; unpredictable risks and hazards related to the development and operation of a mine or mineral property that are beyond our control; reclamation and closure requirements for our mineral properties; potential labour unrest, including labour actions by our unionized employees at Puna Operations; indigenous peoples' title claims and rights to consultation and accommodation may affect our existing operations as well as development projects and future acquisitions; certain transportation risks that could have a negative impact on our ability to operate; assessments by taxation authorities in multiple jurisdictions; recoverability of value added tax and Puna credits balance and significant delays in the collection process in Argentina; claims and legal proceedings, including adverse rulings in litigation against us and/or our directors or officers; compliance with anti-corruption laws and internal controls, and increased regulatory compliance costs; complying with emerging climate change regulations and the impact of climate change; fully realizing our interest in deferred consideration received in connection with recent divestitures; fully realizing the value of our shareholdings in our marketable securities, due to changes in price, liquidity or disposal cost of such marketable securities; uncertainties related to title to our mineral properties and the ability to obtain surface rights; the sufficiency of our insurance coverage; civil disobedience in the countries where our mineral properties are located; operational safety and security risks; actions required to be taken by us under human rights law; competition in the mining industry for mineral properties; our ability to complete and successfully integrate an announced acquisition; reputation loss resulting in decreased investor confidence; increased challenges in developing and maintaining community relations and an impediment to our overall ability to advance our projects; risks normally associated with the conduct of joint ventures; an event of default under our 2013 Notes or our 2019 Notes may significantly reduce our liquidity and adversely affect our business; failure to meet covenants under our senior secured revolving credit facility; information systems security threats; conflicts of interest that could arise from certain of our directors' and officers' involvement with other natural resource companies; other risks related to our common shares; and those other various risks and uncertainties identified under the heading "Risk Factors" in our most recent Annual Information Form filed with the Canadian securities regulatory authorities and included in our most recent Annual Report on Form 40-F filed with the U.S. Securities and Exchange Commission ("SEC").

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Our forward-looking statements are based on what our management considers to be reasonable assumptions, beliefs, expectations and opinions based on the information currently available to it. Assumptions have been made regarding, among other things, our ability to carry on our exploration and development activities, our ability to meet our obligations under our property agreements, the timing and results of drilling programs, the discovery of Mineral Resources and Mineral Reserves on our mineral properties, the timely receipt of required approvals and permits, including those approvals and permits required for successful project permitting, construction and operation of our projects, the price of the minerals we produce, the costs of operating and exploration expenditures, our ability to operate in a safe, efficient and effective manner, our ability to obtain financing as and when required and on reasonable terms, our ability to continue operating the Marigold mine, the Seabee Gold Operation and Puna Operations, dilution and mining recovery assumptions, assumptions regarding stockpiles, the success of mining, processing, exploration and development activities, the accuracy of geological, mining and metallurgical estimates, no significant unanticipated operational or technical difficulties, maintaining good relations with the communities surrounding the Marigold mine, the Seabee Gold Operation and Puna Operations, no significant events or changes relating to regulatory, environmental, health and safety matters, certain tax matters and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices, foreign exchange rates and inflation rates). You are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. We cannot assure you that actual events, performance or results will be consistent with these forward-looking statements, and management's assumptions may prove to be incorrect. Our forward-looking statements reflect current expectations regarding future events and operating performance and speak only as of the date hereof and we do not assume any obligation to update forward-looking statements if circumstances or management's beliefs, expectations or opinions should change other than as required by applicable law. For the reasons set forth above, you should not place undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors

This news release includes Mineral Reserves and Mineral Resources classification terms that comply with reporting standards in Canada and the Mineral Reserves and the Mineral Resources estimates are made in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ significantly from the requirements of the SEC set out in SEC Industry Guide 7. Consequently, Mineral Reserves and Mineral Resources information included in this news release is not comparable to similar information that would generally be disclosed by domestic U.S. reporting companies subject to the reporting and disclosure requirements of the SEC. Under SEC standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically produced or extracted at the time the reserve determination is made. In addition, the SEC's disclosure standards normally do not permit the inclusion of information concerning "Measured Mineral Resources," "Indicated Mineral Resources" or "Inferred Mineral Resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by U.S. standards in documents filed with the SEC. U.S. investors should understand that "Inferred Mineral Resources" have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. Moreover, the requirements of NI 43-101 for identification of "reserves" are also not the same as those of the SEC, and reserves reported by us in compliance with NI 43-101 may not qualify as "reserves" under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

View original content to download multimedia:http://www.prnewswire.com/news-releases/ssr-mining-acquires-8-900-hectares-contiguous-to-marigold-mine-300875970.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/ssr-mining-acquires-8-900-hectares-contiguous-to-marigold-mine-300875970.html

SOURCE SSR Mining Inc.