Get Cash Back and $0 Commissions

+ The Power of TradeStation

Rishabh Mishra 1-Sep-2025 5:50 AM

The Donald Trump administration's recent decision to halt approvals of new solar and wind projects has sent shockwaves through clean energy markets, affecting stocks connected to the renewable sector.

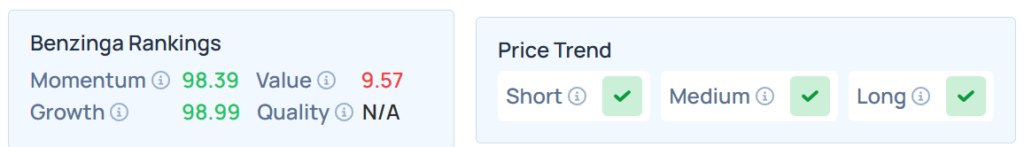

Among the most impacted are BKV Corp. (NYSE:BKV), Bloom Energy Corp. (NYSE:BE), and FTC Solar Inc. (NASDAQ:FTCI), all of which have just entered the "Hitting Bottom 10%" category in current stock rankings, particularly for their value scores.

The value ranking, defined as a percentile-based comparison of a stock's market price relative to fundamental measures such as assets, earnings, sales, and operating performance, shows these stocks are now considered particularly overvalued against their peers. Over the past week:

See Also: 4 Consumer Cyclical Stocks That Are Flashing Strong Fundamental Signals

These stock-specific moves correlate starkly with President Trump's declaration to "not approve wind or farmer-destroying Solar," and legislative efforts to terminate key tax incentives for renewables by 2027.

As government support fades, market participants are reassessing the future earnings potential and asset quality underlying these three companies.

Steel and copper tariffs piled onto the equation, hiking up input costs and further weighing on margins for solar manufacturers and project developers.

The intersection of policy uncertainty and slumping value rankings for pivotal renewables stocks signals heightened risk of further downside. BKV Corp., Bloom Energy, and FTC Solar now stand out as three of the most potentially overvalued stocks in the clean energy space, grappling with shifting U.S. regulatory and fiscal landscapes.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, fell on Friday. The SPY was down 0.60% at $645.05, while the QQQ declined 1.16% to $570.40, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Joey Sussman on Shutterstock.com