Option Spread ParametersUnderlying Stock IdeasPayoffs at ExpirationHistorical Distribution, IV Theo, and Seasonality

| Strategy Parameters | Trading Data | Events | Theoretical Edge | ||||||

|---|---|---|---|---|---|---|---|---|---|

| In Watchlist | Stock Screener | Buy Put Volume | Earnings Date | Theoretical Edge A positive edge (in green) is when the current market price of the spread is a good deal in relation to the theoretical value calculated from the historical distribution. | |||||

| Expiration |

9 Days to Exp (7 Trading Days) |

Return if Stock Flat | Sell Put Volume | Ex-Dividend | Theo Win Rate The frequency with which the current market price of the spread would have resulted in positive returns by expiration, based on the historical price changes available for this analysis. | ||||

| Spread Between Strikes | Cushion To Breakeven | Buy Put Open Int | Company Event | Show Best Only This filter will show you only the best available entry per symbol if selected, taking into consideration the other filters already applied. | |||||

| Moneyness | Bid-Ask Spread | Sell Put Open Int | |||||||

| Buy Strike Delta | Sell Strike Delta | Multi-Leg Traded Volume | |||||||

| Buy Strike IV Lean | Sell Strike IV Lean | ||||||||

| Stock Details | Credit | Theoretical Value | IV-Based Theoretical Value | Credit Put Spread Details | Trading Data | Option Risk Profile | Events | Volatility | Market IV Leans | Technical Indicators | Stock Price Return Distribution for Historical Holding Period Over Selected Timeframe |

Stock Price Return Distribution for Historical Seasonality Over Selected Timeframe |

Strategy Payoff Scenarios | IV Theo Statistics | Today's Multi-Leg Trades Trading volume and volume-weighted average pricing (VWAP) for multi-leg option trades matching the two legs involved in the given strategy. See the Multi-Leg Screener for more details. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Symbol | Name | Stock Price | % Chg | Market Cap |

Market Price The net option premium received by executing this spread trade. Because the option you're selling is a higher cost than the option you're buying, you collect a net premium from the spread. |

Theo. Value Using a historical price return distribution for holding periods matching the # of days to expiration, we calculate a theoretical value of the current spread based on historical price changes available in this analysis. | Theo. Edge A positive edge (in green) is when the current market price of the spread is a good deal in relation to the theoretical value calculated from the historical distribution. | % Win Rate The frequency with which the current market price of the spread would have resulted in positive returns by expiration, based on the historical price changes available in this analysis. | Sharpe Ratio | Analysis | Theo. Value Using historical implied volatilities of similar options with similar days remaining before expiration, we calculate an IV-based theoretical value of the current spread, using the current stock price and interest rate. | Theo. Edge A positive edge (in green) is when the current market price of the spread is a good deal in relation to the theoretical value (calculated from the historical IV-based model). |

% Rank

The percentile rank of the current spread price, within the collection of historical spread theos

(calculated using the historical IV-based model).

Represents the number of historical observations that are below the spread's current market price. |

Analysis |

Credit/Spread Ratio The net option premium received as credit for this spread divided by the difference in dollar amount of the strikes involved. If the spread includes the $10 strike and the $15 strike, this is considered a $5 spread. |

Spread Bid |

Spread Ask |

Buy Delta |

Buy Strike |

Buy Put Bid | Buy Put Ask | Sell Strike |

Sell Delta |

Sell Put Bid | Sell Put Ask | Expiration | Buy Put Volume |

Buy Put Open Interest |

Sell Put Volume |

Sell Put Open Interest |

Max Loss |

Breakeven Price The stock price at which the spread breaks even. If the stock is above this price, the spread will have a positive return. If it is below this price, it will lose money. |

Downside Cushion If the current stock price is above the breakeven price, this is the % change in stock price that exists as a cushion until the stock price reaches the breakeven price |

% Return if Stock Flat The % return for the option spread if the options expire with the same underlying price as the current underlying price, as a percentage of the total amount at risk |

Next Div Ex Date | Next Div Amt | Next Earnings | Buy IV | Buy IV Rank | Sell IV | Sell IV Rank | Underlying Hist Vol 20-Day |

Underlying Hist Vol 1-Year |

Net Delta | As Of Time | Buy Put Lean |

Sell Put Lean |

Moving Avg Indicator |

1-Day Support/Resistance |

% From 52-Wk Low | % From 52-Wk High | Option Order Flow (Net Delta) |

Holding Period Days The historical price return distribution uses intervals of this # of holding days |

# Obs |

% Positive Obs The % of historical price return observations in which the stock had a positive change in price |

% Negative Obs The % of historical price return observations in which the stock had a negative change in price |

Avg Move The average % move in the stock price for this historical price return distribution |

Median Move The median % move in the stock price for this historical price return distribution |

Avg Up Move The average % move in the stock price for this historical price return distribution, for only positive price movements |

Avg Down Move The average % move in the stock price for this historical price return distribution, for only negative price movements |

Period The seasonal period over which we're conducting this seasonality analysis. For example, if the period is May 1 to May 20, we look at the change in stock price from the start date to the end date of the last 12 years (minimum 8 years if available). | # Obs |

% Positive Obs The % of historical seasonal observations in which the stock had a positive change in price |

% Negative Obs The % of historical seasonal observations in which the stock had a negative change in price |

Avg Move The average % move in the stock price for this historical seasonality analysis |

Median Move The median % move in the stock price for this historical seasonality analysis |

Avg Up Move The average % move in the stock price for this historical seasonality analysis, for only positive price movements |

Avg Down Move The average % move in the stock price for this historical seasonality analyis, for only negative price movements |

If Stock -1 StdDev at Exp The % return for the option spread if the options expire and the underlying price has declined one standard deviation from the current price. The standard deviation is calculated from the at-the-money straddle's implied move. |

If Avg Seasonal Down Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average negative % move of the historical seasonality analysis |

If Avg Down Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average negative % move of the historical price return distribution |

% Return if Stock Flat The % return for the option spread if the options expire with the same underlying price as the current underlying price, as a percentage of the total amount at risk |

If Avg Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average % move of the historical price return distribution |

If Avg Seasonal Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average % move of the historical seasonality analysis |

If Avg Up Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average positive % move of the historical price return distribution |

If Avg Seasonal Up Move The % return for the option spread if the stock price at expiration is equivalent to the current stock price plus the average positive % move of the historical seasonality analysis |

If Stock +1 StdDev at Exp The % return for the option spread if the options expire and the underlying price has gained one standard deviation from the current price. The standard deviation is calculated from the at-the-money straddle's implied move. |

Min Value |

Max Value |

Median Value |

Days to Earnings |

# Obs | # Obs Above Current |

# Obs Below Current |

% Obs Above Current |

% Obs Below Current |

Trade Ct | Volume | Last Time | VWAP Last | VWAP Bid | VWAP Ask | Stock Reference |

Many people don't realize that credit put spreads can yield very high returns in a short period of time.

It's not uncommon to see returns of 20% to 30% within a 2 to 3 week time period from bellwether stocks such as AAPL, MSFT or ETFs like SPY.

Of course, there is risk to capital but with options spreads the risk is defined or limited.

Just for comparison sake, think of a junk bond. Junk bonds usually require to give investors high yields because of their low ratings and higher risk.

Would you rather buy a junk bond for 1 year or sell an out-of-the-money bull put spread for 2 weeks in a top notch stock?

The range of returns varies from one credit put spread to another. But first you must understand how to properly find the

return on a spread that you are selling. Let's take a look at the screenshot below for an example.

Percent Return if Flat

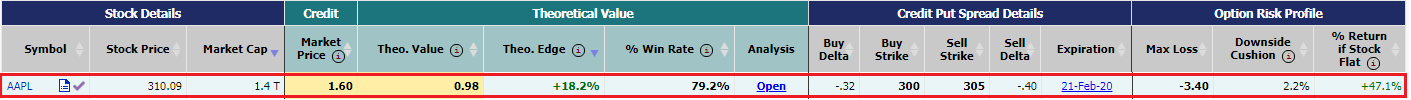

The row that is outlined in red is showing a credit put spread in AAPL with 2 weeks to go at the time of the snapshot.

You can quickly see in the last column that the AAPL credit put spread would return a handsome 47.1% in 2 weeks,

if the stock price remains flat or moves higher by expiration! Let's examine this credit put spread piece by piece.

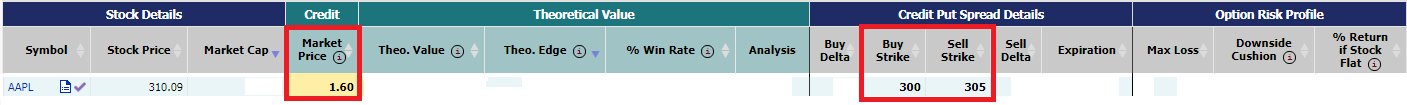

The following screenshot shows you the market price for the spread is $1.60. This is the credit you would receive for selling the

put spread. Also, you can see that the strategy is for a $5 credit put spread; the buy strike is 300 and the sell strike is 305.

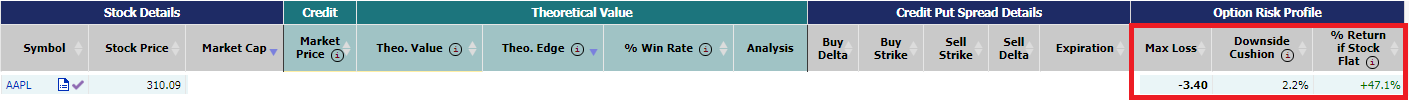

At Market Chameleon, the returns for a credit put spread are calculated based on what you can make against the money at risk. For example,

if you receive $1.60 (the market price) in premium and your max loss is $3.40 then

your percentage return would be 47.1% if all your options expired and were out-of-the-money. See the screenshot below where the percentage

return (if the stock was flat, meaning that the stock didn't move up or down) would be +47.1%. In that scenario, the stock would have to

stay close to the current stock price when you sold the credit put spread.

Max Loss (Amount at Risk)

Because the credit put spread has a maximum risk that you know ahead of time, you can easily assess the spread and decide weather or not if

fits your risk threshold.

The amount at risk is the difference between the strike and what you sell the credit spread. In this example if AAPL falls below

$300 you would have to buy the option spread back for $5 minus the $1.60 you sold it for (total loss -$3.40 or $5-$1.60)

Downside Cushion

Things get even better, you can sell a credit put spread that has a downside cushion.

Which simply means that if you sell an out-of-the money put spread

then the stock can still fall and you can make money. It can drop to your higher strike for you to make money and can drop below the

sell strike by the amount you sold the spread before you lose money. And you will know exactly how much the stock price can drop

before you start to lose money. Check out the above example,

where AAPL stock is $310.09 and you sell the 300-305 put spread for $1.60. As long as the stock at expiration is above $305 you

profit the full $1.60 and your breakeven is 305 -$1.60 = 303.40 or 2.2% below the stock price.

Just imagine if you could buy a stock and not lose any money until that stock price went down by 2.2%!!!

Now you can quickly see that if AAPL's stock price goes up, stays where it is ($310.09), or even goes down to $305 you will still

make a whopping 47.1% return on your money at risk.

When comparing the credit put spread vs other risky trades, such as day trading penny stocks, you can easily see the big difference.

Trying to execute a swing trade on penny stocks would require an explosive move to realize the same gain (47.1%) in this example.

Whereas the stock price for this credit put spread doesn't even have to move!

Additionally, your risk is defined and limited providing you with the opportunity to reestablish a long position at a lower price or

moving on to another trade (depending on your outlook at the time).

When you use the Market Chameleon put spread screener, you have all the essential information you need at your fingertips.

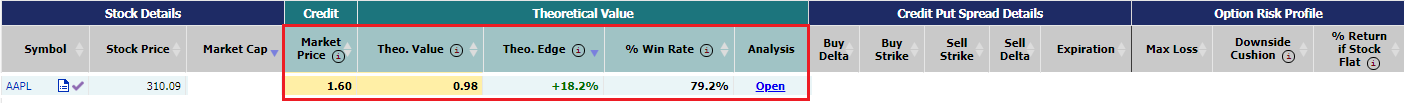

The most unique, and helpful, feature you will have at your disposal is the theoretical edge and win rate for each put spread. You will truly be able to up

your game by using the theoretical analysis section of the credit put spread screener (see screenshot below).

To help you understand the importance of the Theoretical Values, lets make a comparison in the real estate market. Let's pretend you are a

developer and want to flip houses.

If you are considering buying a house on the market for $60K and you know it needs $15K in total costs (repairs, closing costs, etc.),

you would want to know if you are getting a good deal.

Therefore, you would research the area for similar houses and try to find out at what price those houses sold

(commonly referred to as the "comps" or comparables i.e. referring to properties with similar characteristics to the property whose value is of interest).

After gathering the data, you find out that within the past year, on average, the houses sold for $100K.

Now that house on the market for $60K seems like it has some really good investment potential.

Similar to the "comps" in real estate, Market Chameleon provides you with the theoretical value and win rate of each option spread.

The theoretical value is based on historical data of option strategies with the same characteristics. The calculation is based on the average return

as if you made the same trade over and over again during an extended period. For instance, let's say you wanted to know what the average return would be

if, for several years, you sold a $5 credit put spread in AAPL with 2 weeks to expiration and no earnings announcement within that time frame.

Additionally, the win rate tells you how frequently those historical credit put spreads would have

resulted in a profit (at expiration and based on historical stock moves).

A screener is an essential tool to traders that can quickly find the best trade candidates. It displays relevant information that is

logically organized in a table, which can be sorted and filtered.

As an example, let's say you wanted to invest your money into a CD (Certificate of Deposit), savings account, or money market account.

The first thing you would want to compare are the interest rates.

It would take forever to contact all the banks or even go to their websites to find the best interest rates and different terms.

Now imagine how hard that would be if you needed to do that every day.

In fact it would be impossible to call all the banks, there just isn't enough time in the day for you to do all that research.

You need a special tool that would be able to gather all the data from each bank in the background and then aggregate and present that

information to you. Furthermore, that tool would need to give you the ability to search, narrow down the results and sort by the best,

so that you could easily find the best interest and terms that meet your investment goals.

And that is exactly what a screener (for bank interest rates in this example) would do for you. This way you can do something that

wouldn't even be possible (getting all the bank investment opportunities and comparing them against each other) and, more importantly,

you would save time doing it.

Simply put, a screener is just a tool that helps you easily find what you're looking for quickly. Traders have a wide range of

preferences based on their reward goals and risk tolerance. The credit put spread screener is such a tool and it scans the entire market and brings back

only relevant bull put spread trade scenarios. As with all the screeners, they will follow a general structure.

Bull put spreads typically have a bullish to neutral directional bias, meaning that a trader is expecting the underlying stock price to go up or

remain close to flat. So the first thing a trader will want to do is find stocks that they believe will behave accordingly. There are many ways to

do this and everybody has their own detailed analysis.

But in general, you will look at news and/or technical indicators to help you formulate an opinion and give you an idea of where the stock is likely to go.

After finding a stock, a trader will look at the option chain and go through various scenarios to determine what put spread will give him the most

bang for his buck. This is a tedious process.

However, Market Chameleon has streamlined the whole procedure into one tool where you can search for the stock and the best spread all in one place.

With the Market Chameleon credit put spread screener, you gain a leg up and get the stock technical analysis in the same location as finding the best put spreads.

Let the system handle the mundane and tedious tasks of finding the underlying symbol in a bullish trend and immediately cross referencing that

with the best put spread trades. Which allows you to spend your time efficiently and focusing on the trade.

For example, Market Chameleon helps you by allowing you to filter for stocks based on bullish indicators such as:

The most effective way to scan for credit put spreads is with a powerful screener. The Market Chameleon credit put spread screener allows you to

scan for the best credit put spreads using the latest technology.

Different traders will have different criteria, but ultimately you will want the highest probability of success and ROI (return on investment).

An effective scanner will have everything you need in one location and give you the ability to try out a number of different criteria before

you settle on something that matches your investment strategy.

The Market Chameleon credit put spread screener gives you the ability to save and edit multiple scans (filter criteria). Once you've

done your analysis and know what you like, a scan should be readily accessible and easy to retrieve. All the different combinations

stored so you don't have to write it down or remember them, allowing you to focus on the next step of your trade.

And if you need a starting point you can simply use the pre-set filters.

While the criteria to evaluate the best credit spreads may vary from one trader to the next, the general areas of interest will include the

theoretical edge, win rate and downside cushion. The edge is your expected return if you performed this trade (same conditions) over

many times (similar to the edge a casino has at the roulette table). The win rate is the historical percentage of times you would have

made a profit if you made a similar trade. And the downside cushion is how much the underlying stock can go down before you start

losing money on your spread position. Each trader will develop their own strategy and combination to find the best credit put spread

that fits their risk threshold and profit goals. There are millions of scenarios and not enough time in the day to evaluate them all.

Unless, of course, you have a credit put spread screener.

The Market Chameleon credit put spread screener allows you to choose your filters so that you can eliminate several spreads right off

the bat and only focus on the ones that matter. Then after you have narrowed down the results you can take it a step further.

For example, let's say you filtered out certain spreads and then you have 100 potential AAPL credit put spreads. Well, you're

probably not going to perform 100 trades on AAPL all at once. You might only want the best trade in AAPL based on the highest

theoretical edge. You would simply select "Best theo edge by symbol" on the "Show Best Only" filter and the screener will

immediately be able to pinpoint the best AAPL credit put spread with the highest theoretical edge for you.

Going into any trade, you will want to know how much you are risking and how much you can make. It's the bottom line in trading.

The max loss is very important because it will let you know right away if the trade is within your risk tolerance.

For credit put spreads, the max loss would be the difference between the credit received and the max amount you would have to

buy back the spread if it finished in-the-money. Many traders will use this as a starting point and a way to compare similar

credit put spreads. In financial analysis, it's important for you to compare relative trade ideas across several different metrics.

Furthermore, once you've established your max loss threshold, it's important to know if that the reward (the maximum gain) is worth the risk you're

taking. The Market Chameleon credit put spread screener makes these data elements easy to use. The maximum gain for a credit put spread is

simply the market price, which would be the initial credit received for selling the spread.

The delta of an option tells a trader the probability of that option expiring in the money. This is important for credit put spreads because it

lets the trader know the probability (based on the market consensus) that the different option legs of the trade will be in the money (by expiration)

and, in turn, resulting in the spread making or losing money. In a credit put spread if you are selling a strike that has a high probability

(i.e. a high delta) of expiring in the money then the premium you are receiving for that spread may not be worth the higher risk.

As a trader, maybe you don't want anything that has over a 75% chance of expiring in the money because you view that as too risky.

You can use the delta filter (in this case any delta above -.25) to set this parameter.

With the Market Chameleon screener you can set a delta threshold on each leg of the spread by using the Buy Strike Delta and Sell Strike Delta filters.

In order to make things more convenient, you can also select credit put spreads that are in-the-money, out-of-the-money or somewhere in between.

Along with many other pieces of information, the credit put spread screener gives you more than enough to evaluate a put spread and make an informed decision.

Credit (Short) Put Spreads involve buying put options for an expiration of a particular underlying asset at one particular strike price and selling the same number of put options for that same expiration at a higher strike price. Because you are selling options at a higher premium than you are buying, this strategy results in a net premium for the investor at the time of the trade.

We sure do!

Click here to see helpful videos.

Credit put spreads, also known as bull put spreads, have aBullish Market sentiment.

We compile an interval-based historical price return distribution for the underlying stock

If there are 20 days to go until expiration, we go back historically and look at intervals with a 20-day holding period for changes in stock price

If there is an earnings date coming up before expiration, we look at only those historical periods that included an earnings date

Similarly, if there is no earnings date before expiration, we look at only historical periods without earnings

We use those intervals to calculate a theoretical value for the spread based on those historical changes in stock price

Click on the Analysis link for a more detailed breakdown

Example: The stock price is $100, and we have a credit put spread of Buy 90 strike and Sell 95 strike, with 25 days to go before expiration. We know that if the stock finishes below $90 (down -10%), the spread will be worth $5.00. If the stock finishes above $95 (down -5%), the spread will be worthless ($0.00 value).

Our historical return distribution could tell us, for example, that for 25-day holding periods in the past, the stock has finished -10% or below 25% of the time, and -5% or above 75% of the time.

To calculate the theoretical value then, we would add the value of the first part [25% of returns x $5.00 value = $1.25] to the value of the second part [75% of returns x $0.00 value = $0.00] to get the result, $1.25.

Using the historical distribution, we calculate a theoretical value of the current spread based on these past changes in stock price.

To determine the edge, we take that value and compare it to the current market price of the spread.

If the theoretical value is greater than the amount received to sell the spread (Credit), then the theoretical edge will be negative. If it is lower, it will be positive.

Using the historical distribution, win rate represents the percentage of these historical observations where the current spread would have resulted in a positive return (given the observed change in stock price over the specified holding period).

This means that the end value of the spread would have been less than the amount received from the initial sale (Credit).

For the historical distribution, we've implemented a new model utilizing dynamic implied volatility ranges to narrow results around the symbol's current volatility environment. The implied volatility (IV30) is recorded at the start of each historical interval. We only select the 50% of historical observations where the IV30 at the time of the observation is the closest to the current IV30 -- 25% above and 25% below.

This way, if the current IV30 is exceptionally high or exceptionally low, we are focusing only on other historical observations that showed similar volatility.

We only utilize this method if we can ensure at least 16 observations. Otherwise, we continue to use all historical observations, as was the case prior to this method being applied.

We look at seasonal changes in stock price for up to the last 12 years (with a minimum of 8 years)

If today is May 1 and the option expires May 20, we look at the stock's price change for each year from May 1 to May 20

It finds the start and end value of the stock price for those date ranges, and calculates statistics from it

We use those values to calculate the average return and % positive observations for the stock over those results

Click on the Analysis link for a more detailed breakdown

Note: E indicates earnings within expiration

Tip: Click on the Expiration link to go directly to the option chain