Energy leads the pack as S&P 500’s top sector in Q1

Seeking Alpha News (Wed, 02-Apr 2:42 PM)

The Energy Select Sector SPDR Fund ETF (NYSEARCA:XLE), which tracks the S&P 500 energy sector, surged 7.8% in the first quarter of 2025, heavily outperforming the Wall Street’s benchmark S&P 500 (SP500) index, which slipped by 4.4% during the quarter.

The fund, which includes companies involved in oil production, drilling, refining, and transportation, was the biggest quarterly gainer in the S&P 500 sectors, even as oil prices slightly fell.

U.S. President Donald Trump's trade wars shifted the market narrative from concerns about a "soft landing" for the economy and potential Federal Reserve interest rate cuts to fears that tariffs would reignite inflation, erode consumer confidence, and increase the likelihood of a recession.

Investors turned to energy stocks in search of stability, acknowledging the sector's resilience in inflationary environments as a defensive stock, while energy companies saw strong earnings driven by high commodity prices.

Fluctuating oil prices, influenced by supply constraints and geopolitical events, have continued to sustain inflationary pressures.

Bank of America said its clients piled into energy more than any other sector in mid-March as the S&P 500 went into a correction; institutions were big buyers as the group recorded its biggest inflow since the Silicon Valley Bank crisis, the bank's analysis showed.

Moving forward with the year, the energy sector is likely to sustain its momentum, driven by robust earnings, supply constraints, and persistent inflationary pressures.

"Oil stocks finally seem ready to break out of their narrow, two-and-a-half year trading range. We see a potential profit of 50% over the next two years," pointed out a Seeking Alpha analyst.

Industries performance:

In Q1, the Energy Equipment & Services (SP500-101010) industry climbed 4.3%, while the Oil, Gas & Consumable Fuels (SP500-101020) advanced 8.5% in the quarter.

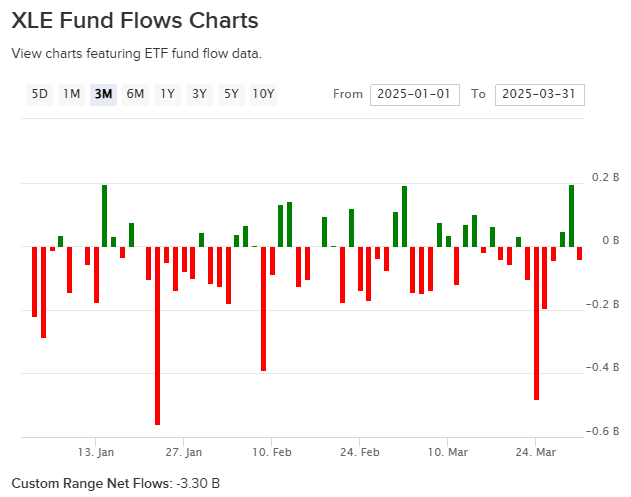

Fund Flows

XLE reported fund outflow of $3.3B during the last quarter.

Q1 top performers:

- Hess Corporation (HES): +22.3%

- Texas Pacific Land (TPL): +20.9%

- Chevron Corporation (CVX): +16.9%

- Devon Energy (DVN) +16.4%

- EQT Corporation (EQT): +15.9%

Q1 bottom performers:

- APA Corporation (APA) -6.7%

- Halliburton (HAL) -6.4%

- ONEOK (OKE) -1.1%

- Diamondback Energy (FANG): -0.9%

What Quantitative Measures Say

The Energy Select Sector SPDR Fund ETF (XLE) experienced a significant improvement in its Seeking Alpha Quant Rating, rising from a Hold (2.5/5) to a Buy (4.3/5). Momentum improved dramatically from D to A+, Expenses increased from A to A+, and Liquidity stayed strong at A+. The Risk rating stayed at D-, while Dividends held steady at B+.

What Analysts Expect

Seeking Alpha analysts were also cautious and gave XLE a Hold rating with a score of 3.3. Two out of six analysts surveyed by Seeking Alpha in the last 90 days consider it a Buy, four recommended the ETF as a Hold, while none gave a Sell rating.

More on etc.

- Alpinum Investment Management Q2 2025 Letter

- Domino's Pizza: A Slice Of Profitable Growth - Why Investors Should Take A Bite

- Flowers Foods: Simple Mills May Not Salvage Stagnating Sales

- Qualcomm ticks up as chipmaker officially unveils Snapdragon 8s Gen 4

- Biggest stock movers Wednesday: NCNO, TTEC, EWTX, BB, ANGO and more