S&P 500 Industrial ends almost flat in Q1, Airlines drag index lower

Seeking Alpha News (Wed, 02-Apr 10:15 AM)

The Industrial Select Sector SPDR Fund ETF (NYSEARCA:XLI), which tracks S&P 500 Industrial Index (SP500-20) closed almost flat, down just 0.52% at the end of Q1, while the broader index S&P500 ETF (SPY) had a bad start to 2025, crashing 4.55% at the end of Q1.

Despite overall market difficulties, eight S&P sectors remain positive for Q1, with the Energy Select Sector SPDR® Fund ETF leading the way.

Industries Q1 Performance

Top 5 movers of Q1:

Gainers:

Republic Services (RSG) +20.4%.

GE Aerospace (GE) +20.1%.

Howmet Aerospace (HWM) +18.5%.

Waste Management (WM) +15.7%.

RTX (RTX) +15%.

Losers:

United Airlines (UAL) -31.78%.

Delta Airlines (DAL) -30.6%.

Hubbell (HUBB) -21.1%.

Quanta (PWR) -19.5%.

Generac Holdings (GNRC) -18.9%.

Deteriorating consumer sentiment, fears of a return of problematic inflation, and concerns surrounding a boycott of U.S. tourist destinations weighed on the airline sector, causing shares of major players in the sector to lose altitude in Q1.

What Quantitative Measures say?

Seeking Alpha’s Quant rating has given XLI a BUY rating, with a score of 3.67 out of 5. The rating system has given the industrial sector tracking fund an A+ in liquidity and expenses, A in dividends, B in momentum and a D in risk.

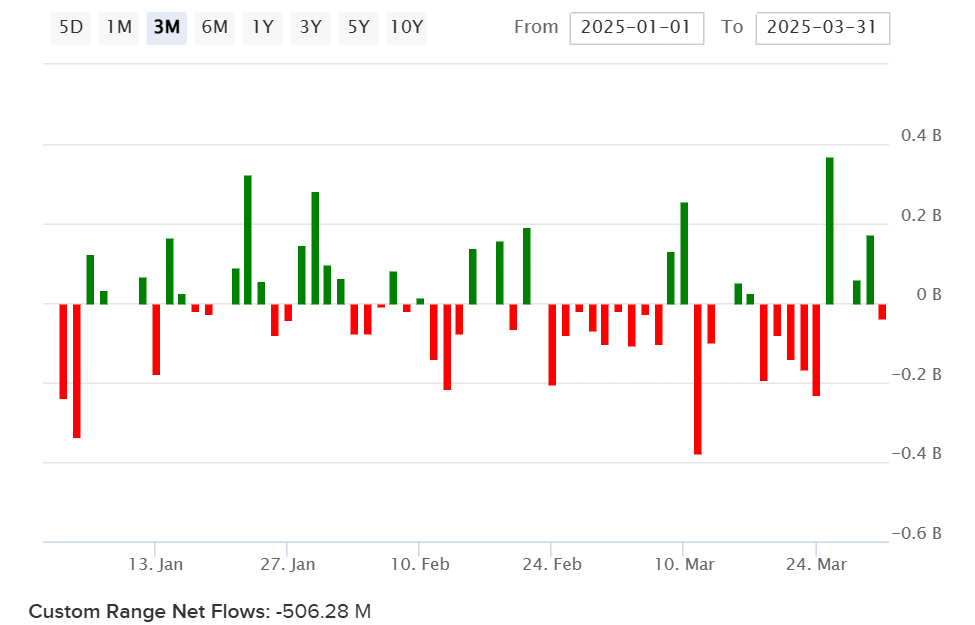

Fund Flows

The Industrial Select Sector SPDR Fund ETF recorded an outflow of $506.28M in the first quart

More on Industrial Select Sector SPDR Fund ETF

- XLI: Industrials Sector's Earnings Growth Power Is Likely To Drive Healthy Returns

- Oppenheimer Asset Management remains bullish on equities despite market volatility

- Wall Street slumps for the week on more tariff turmoil, nears correction territory again

- Seeking Alpha’s Quant Rating on Industrial Select Sector SPDR® Fund ETF

- Dividend scorecard for Industrial Select Sector SPDR® Fund ETF