Gold tops $3,200/oz for first time as Trump tariffs trigger global recession fears

Seeking Alpha News (Fri, 11-Apr 3:23 AM)

Gold prices (XAUUSD:CUR) hit a record high in Asian trade on Friday, as the escalation in the U.S.-China trade war prompted demand for the safe-haven asset.

The yellow metal clocked a 6% gain this week, outpacing all other metals, as investors piled into bullion and the yen amid fears of a worldwide recession.

Spot gold (XAUUSD:CUR) was up 0.5% at $3,204.23 an ounce, after hitting an all-time peak of $3,219.84 earlier in the session. Spot silver (XAGUSD:CUR) gained 0.5% to $31.33.

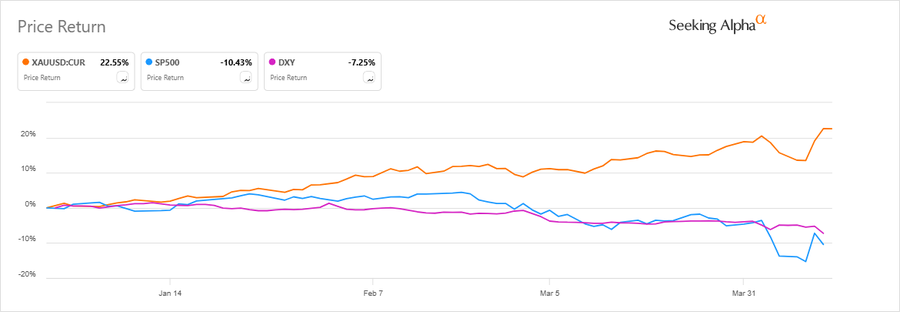

The dollar index (DXY), meanwhile, headed for a third weekly drop, with the Bloomberg Dollar Spot Index down 1.5% overnight, its biggest plunge in three years.

Seeking Alpha

"Risks and uncertainty remained high despite Trump announcing a 90-day pause on the reciprocal tariffs," Daniel Hynes Senior Commodity Strategist with the ANZ said.

President Trump said that tariffs on Chinese imports are now at least 145%, which includes both a 125% rate that covers reciprocal duties as well as levies imposed on China for retaliating on US import taxes.

Investors also shrugged off data which showed U.S. inflation cooled in March.

Gold, traditionally seen as a hedge against uncertainty and inflation, has risen more than 22% this year.

ETFs: (NYSEARCA:GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (RING), (BAR), (OUNZ), (SLV), (PSLV), (SIVR), (SIL), (SILJ)