U.S. benchmark ETF vastly underperforms China and others since Trump's inauguration

Seeking Alpha News (Sat, 29-Mar 2:42 PM)

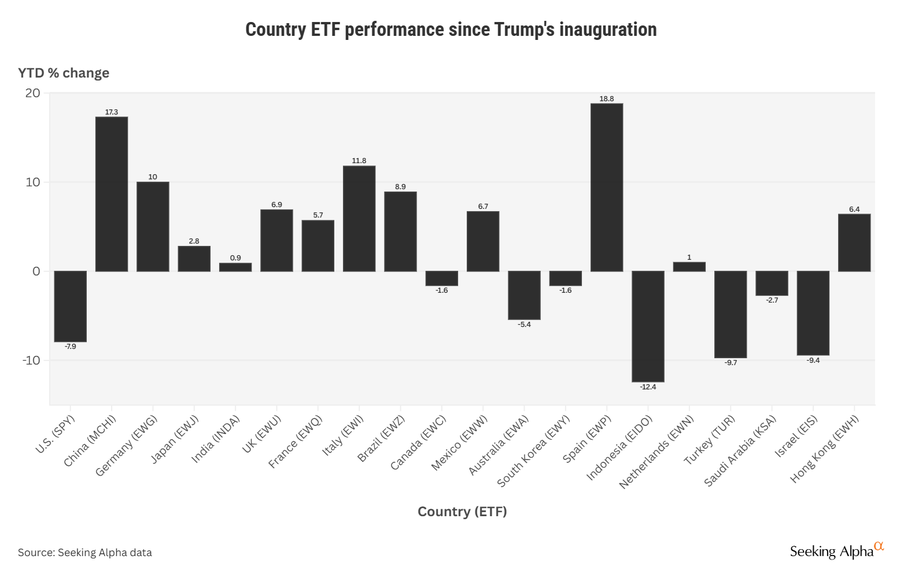

Since U.S. President Donald Trump's second term began, the country's benchmark exchange-traded fund has vastly underperformed top economic peers amid an escalating trade war.

Trump was inaugurated on January 20, 2025. Since then, the SPDR S&P 500 ETF Trust (NYSEARCA:SPY) - the world's third-largest exchange-traded fund that tracks Wall Street's benchmark S&P 500 index (SP500) - is -7.9% YTD.

See below for a chart comparing the SPY's performance to the benchmark ETF of 19 other major nations:

Seeking Alpha data

As can be seen from the chart, the U.S. ranks number seventeen out of twenty in terms of performance. The ETFs for Indonesia (NYSEARCA:EIDO), Turkey (NASDAQ:TUR) and Israel (NYSEARCA:EIS) have fared worse than the SPY.

On the other hand, Spain (NYSEARCA:EWP) topped the list with a hefty +18.8% YTD jump.

Notably, China (NASDAQ:MCHI) came second on the list, with an advance of +17.3% YTD. The Asian nation and the world's second-largest economy has already been targeted by Trump in his fledgling second term, after bearing the brunt of his ire during his first run as U.S. President from 2017 to 2021.

Canada (NYSEARCA:EWC) and Mexico (NYSEARCA:EWW), two other countries that have been targeted by Trump, have seen differing fortunes: the former is -1.6% YTD while the latter is +6.7% YTD.

Nations around the globe will be watching for April 2, the day on which Trump has said he will announce reciprocal tariffs.

Here are some other popular ETFs that track the benchmark S&P 500 (SP500): (NYSEARCA:VOO), (NYSEARCA:IVV), (NYSEARCA:RSP), (NYSEARCA:SSO), (NYSEARCA:UPRO), (NYSEARCA:SH), (NYSEARCA:SDS), and (NYSEARCA:SPXU).

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.

Related stories

- INDA: Compelling Entry Point After The Indian Downturn

- EWJ: Mixed Conditions Make This A Trading Play

- German Stocks Over U.S. Stocks? Not So Fast...

- Wall Street slumps for the week on more tariff turmoil, nears correction territory again

- Dow’s decline: Biggest losers and winners as blue-chips index faces Q1 loss