How did the U.S. calculate reciprocal tariff rates, and why are economists baffled?

Seeking Alpha News (Thu, 03-Apr 11:26 AM)

U.S. President Donald Trump's long-awaited reciprocal tariffs plan was finally unveiled on Wednesday, with a baseline 10% tariff applied on imports from all countries and even higher half-reciprocal tariff rates on certain nations.

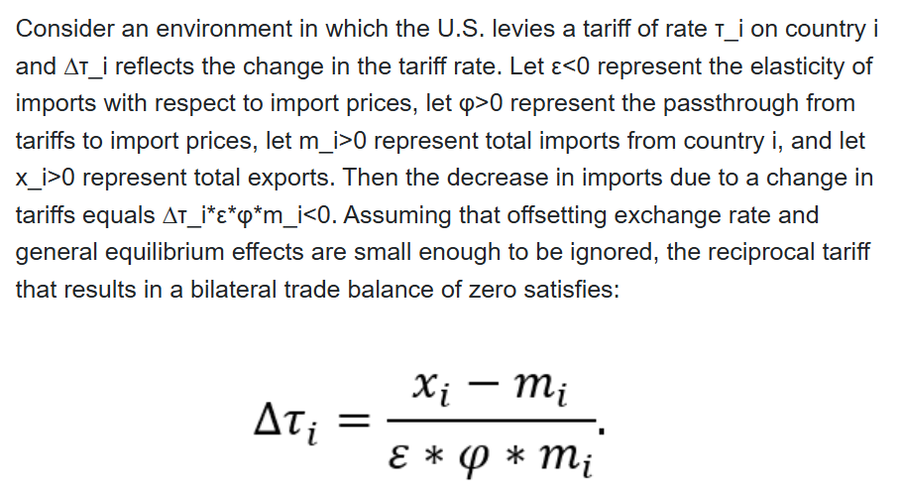

According to the U.S. Trade Representative (USTR), "reciprocal tariffs are calculated as the tariff rate necessary to balance bilateral trade deficits between the U.S. and each of our trading partners."

"This calculation assumes that persistent trade deficits are due to a combination of tariff and non-tariff factors that prevent trade from balancing. Tariffs work through direct reductions of imports," the agency added.

See below the USTR's basic approach to calculating the reciprocal tariff rates:

U.S. Trade Representative

As per the USTR, import and export data from 2024 was used for the calculations. Meanwhile, the price elasticity of import demand, e, was set at 4. The elasticity of import prices with respect to tariffs, f, was set at 0.25.

However, several economists pointed out that, as per the USTR's parameters, "e" and "f" would basically cancel each other out (as 4 x 0.25 = 1). Which would mean that, in essence, the reciprocal tariff rate formula is actually just trade deficit divided by imports.

Scott Lincicome, vice president of general economics at the Cato Institute, called the reciprocal rate calculations "utterly detached from reality."

"President Trump thinks the trade deficit is a national emergency. To wit, the 'formula' behind the so-called reciprocal tariffs is simply a function of bilateral trade deficits. Contra Trump, the trade deficit is not inherently bad; and imposing tariffs won't reduce it anyway," Erica York, vice president of federal tax policy at the Tax Foundation, said.

Ivan Werning, a professor of economics at the Massachusetts Institute of Technology, pointed out that the "basic demand theory" applied by the USTR made sense if used in isolation on a single small trading partner, but not if applied widely to many "non trivial" ones.

"Why? Applied on single small economy: no significant cross demand effects or effects on exports. Makes sense (parameter choices aside). Applied more broadly, as it has been, to many trading partners: simply no longer tenable. Cross effects and GE effects cannot be ignored," Werning said.

"Bottom line: when applied broadly, economic theory robustly suggests you are unlikely to get as strong trade balance reductions and you need more parameters to know (including some pertaining to saving/investing decisions)," he added.

U.S. stocks (SP500)(COMP:IND)(DJI) cratered on Thursday as sentiment globally was hammered by Trump's reciprocal tariffs.

Here are some popular exchange-traded funds that track Wall Street's major averages: (NYSEARCA:DIA), (NYSEARCA:DDM), (NYSEARCA:UDOW), (NYSEARCA:DOG), (NYSEARCA:DXD), (NYSEARCA:SDOW), (NYSEARCA:SPY), (NYSEARCA:VOO), (NYSEARCA:IVV), (NYSEARCA:RSP), (NYSEARCA:SSO), (NYSEARCA:UPRO), (NYSEARCA:SH), (NYSEARCA:SDS), (NYSEARCA:SPXU), (NASDAQ:QQQ), (NYSEARCA:QLD), (NASDAQ:TQQQ), (NYSEARCA:QID), and (NASDAQ:SQQQ).

Dear readers: We recognize that politics often intersects with the financial news of the day, so we invite you to click here to join the separate political discussion.