Gold stocks: Seeking Alpha Analysts vs. Wall Street

Seeking Alpha News (Mon, 31-Mar 10:21 AM)

Seeking Alpha

Recently, spot gold (XAUUSD:CUR) closed above the $3,000/oz price level for the first time and continues to hold above that level.

The demand for the safe haven currency is said to be fueled by the current macroeconomic uncertainty as investors see heightened geopolitical, inflation, and tariff risks.

Turning to the yellow metal miners, the VanEck Gold Miners ETF (GDX) and iShares MSCI Global Gold Miners ETF (RING) have jumped over 30% since the start of the year, significantly outperforming the broader market.

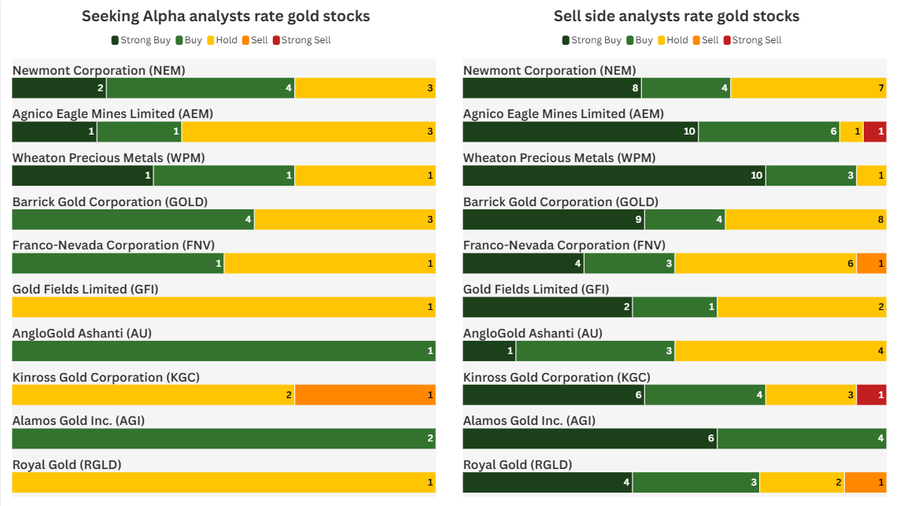

In such a prevailing atmosphere, Wall Street analysts appeared more bullish on this group of stocks than SA analysts. Last week, UBS raised its gold target to $3,200/oz.

Looking at the chart above, Agnico Eagle Mines (AEM), Franco-Nevada Corp (FNV), Kinross Gold Corp (KGC), and Royal Gold (RGLD) featured a wide range of opinions from Wall Street.

While, Newmont Corp (NYSE:NEM) and Barrick Gold Corp (NYSE:GOLD), Alamos Gold (NYSE:AGI) received similar recommendations from both sides.

Wheaton Precious Metals (NYSE:WPM), and Gold Fields (NYSE:GFI) saw the sell-side's optimism cross with SA's somewhat cautious outlook.