Gold breaks $3,100, posts best quarterly gain in nearly four decades

Seeking Alpha News (Mon, 31-Mar 5:50 AM)

Gold prices rallied above $3,100 per ounce for the first time on Monday, on course for its biggest quarterly gain in over 38 years, as global tariffs and geopolitical tensions push investors toward safe-haven bets.

Spot gold (XAUUSD:CUR) gained as much as 0.9% to top $3,115 an ounce, beating the previous all-time high set on Friday.

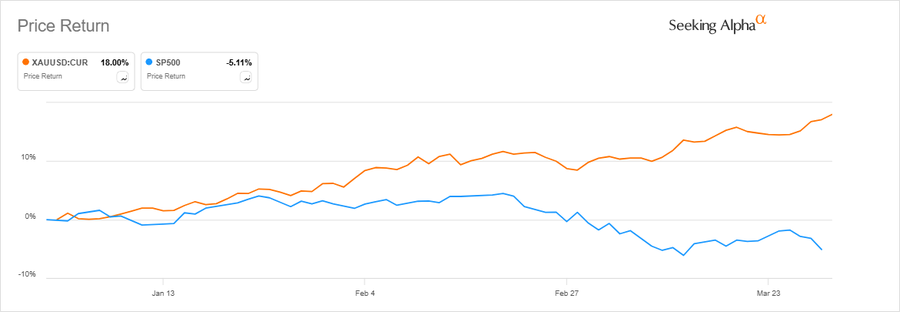

The metal has scaled at least 15 all-time highs, and is up about 18% this year, as a wave of tariffs and foreign policy changes since Trump took office triggered chaos at the economic and geopolitical levels.

Seeking Alpha

President Trump's threat of “permanent” 25% tariffs on auto imports, has intensified trade tensions.

"Trump’s unpredictable trade policy has been the key driver for gold so far in 2025, with prices up by more than 16% year-to-date, extending its momentum from 2024," ING analysts said.

"We see uncertainty over trade and tariffs, along with central bank buying and inflows into ETF holdings continuing to buoy gold prices."

Meanwhile, the latest U.S. data showed the PCE price index - the Federal Reserve's preferred gauge of inflation - rose 2.5% in the 12 months through February, still above the central bank's 2% target.

Copper has at the same time continued to retreat from its nine-month high as expectations for the ex-U.S. tightness are retreating following reports earlier this week that US tariffs on copper imports could be imposed within weeks, not months.

"Tariffs are bearish for copper and other industrial metals in the context of slowing growth and keeping inflation higher for longer," Warren Patterson and Ewa Manthey said in a note to clients.

ETFs: (NYSEARCA:GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (RING), (BAR), (OUNZ), (SLV), (PSLV), (SIVR), (SIL), (SILJ)

More on SPDR Gold Trust ETF, Gold Spot Price, etc.

- Gold Climbs To A New Record High

- Wall Street Lunch: Wall Street Waves White Flag On Gold

- Gold Price Forecast: Will Tariffs And ETF Demand Drive XAU/USD Higher?

- Surge in gold imports continues to distort trade figures, analysts say

- These 5 market inflection points support bonds, international stocks, gold: BofA