Real estate stocks down marginally amid the broader bond selloff, rising yields

Seeking Alpha News (Sat, 12-Apr 12:00 PM)

Real estate stocks lost ground in a week that saw the benchmark S&P 500 index advance more than 5% amid the broader bond selloff and rising long-term Treasury yields.

The United States 10-Year Bond Yield (US10Y) rose 48 basis points during the course of the week to 4.49%, while the United States 20-Year Bond Yield (US20Y) was up 50 basis points to 4.94%. The United States 30-Year Bond Yield (US30Y) increased 45 basis points to 4.87%.

Traditionally, yields fall as investors seek safety by buying bonds during equity market stress. However, that traditional safe-haven role has been called into question amid this week's broader bond selloff.

While the equity market swings have garnered most of the attention this week with markets notching extreme highs and lows, Barclays argued that swings in the bond market have been the "most worrisome part of price action" that took place so far this week.

The investment institution went on to add that "until Treasuries stabilize and start to behave normally, risk assets will struggle, in our view".

Barclays analysts say the recent volatility in the bond market remains somewhat of a mystery. One possible explanation the institution pointed to is investors who may have entered swap spread widening positions, expecting relief on the Supplementary Leverage Ratio, only to face pressure as those bets moved against them.

Another theory involves the unwinding of the "basis trade". There's also ongoing speculation that foreign investors—particularly from Asia—may be behind the selling activity.

Total returns across REITs have recently been exhibiting an inverse relationship with the US10Y changes.

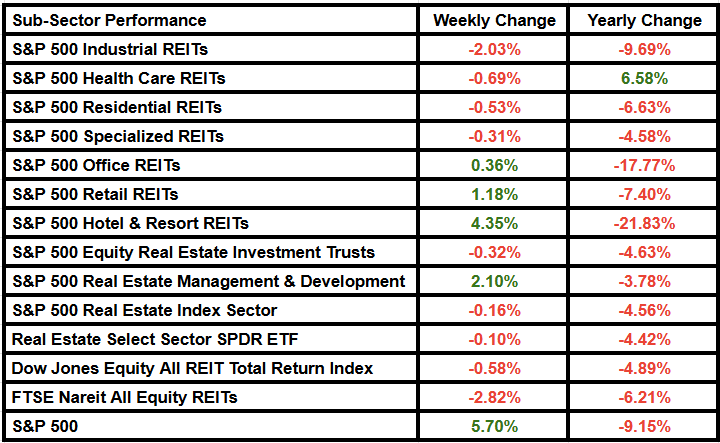

The FTSE Nareit All Equity REITs index (INDEXFTSE: FNER) dipped 2.82% on a weekly basis to 718.38. Dow Jones REIT Indx Equity REIT Total Return Index (NASDAQ:REIT:IND) was down 0.58% to 2,468.87.

The S&P 500 Real Estate Index Sector (SP500-60) retreated 0.16% from last week to 244.25, while the accompanying The Real Estate Select Sector SPDR Fund ETF (NYSEARCA:XLRE) fell 0.10% to 38.92.

XLRE gained 5.74% on Wednesday to close at 39.21 when the Wall Street notched its best day since the financial crisis of 2008. The day saw the Trump administration announce a 90-day pause on reciprocal tariffs against most countries.

But the gains could not offset the losses logged in most trading sessions of the week.

The ETF was -2.41% to 38.02 on Monday, logging outflows of $42.86M. XLRE dipped 2.47% to 37.08 on Tuesday, having seen outflows of $45.63M. The fund saw outflows of $21.57M on Thursday, recording losses of 2.12% to 38.38 after Wednesday's gain.

XLRE gets a Sell rating from Seeking Alpha's Quant Rating system and a Buy rating from SA analysts.

Earnings Season

Amidst the tariff frenzy, a primarily green earnings scorecard brought much needed cheer to the markets. Out of the ten S&P 500 companies that reported earnings this week, eight of them beat EPS expectations, while all of them topped revenue estimates.

For next week, the S&P 500 real estate company reporting Q1 earnings is Prologis (PLD). The consensus FFO estimate is $1.38 (+7.87% Y/Y) and the consensus revenue estimate is $1.99B (+9.01% Y/Y).

Other major real estate names reporting next week are Manhattan Bridge Capital (LOAN), First Industrial Realty Trust (FR), SL Green Realty (SLG), and Equity LifeStyle Properties (ELS).

Real estate as an S&P 500 sector has seen upward revisions to revenue estimates and positive revenue surprises since the end of the quarter. The sector has seen an increase to its blended Q1 revenue growth rate to 4.1% from 3.7%, an April 11 report by FactSet showed.

Real estate ranks second among the four S&P 500 sectors to record an increase in its revenue growth rate, or a decrease in revenue decline, since the end of the quarter, the report noted.

However, the sector takes the lead among the six S&P 500 sectors expected to report a year-over-year decline in its blended Q1 net profit margin. The metric is expected to drop to 34.5% from 36.2% for the quarter, according to FactSet.

Winners & Losers

Here are the top S&P 500 real estate losers of the week:

- Alexandria Real Estate Equities (ARE) -5.36%

- Crown Castle (CCI) -4.27%

- American Tower (AMT) -3.16%

- Extra Space Storage (EXR) -3.14%

- Essex Property Trust (ESS) -2.79%

Here are the top S&P 500 real estate gainers of the week: