Wall Street tempers expectations for banks' Q1 earnings

Seeking Alpha News (Thu, 10-Apr 2:36 PM)

With the spike in economic uncertainty, investors are likely to be attuned to banks' guidance when they report Q1 earnings, starting on Friday.

Morgan Stanley analyst Betsy Graseck expects managements to lower revenue for FY2025 during Q1 earnings. "With recent market volatility, clearly the outlook for investment banking and wealth fees needs to be tempered," she wrote in a note to clients. The firm's equity analysts lowered their median 2025 Y/Y revenue growth estimates to 3% from 4%. For those banks that provide loan growth guidance, expect that to decline, too, she added.

And for Q1 itself, after two "beat and raise" quarters in a row for large cap banks, Morgan Stanley now expects a "meet and keep" quarter.

Given the volatility in markets, "many investors wonder what will even matter this EPS season, as any positive prints will likely be seen as backward looking and stable-ish outlooks may be met with skepticism," wrote UBS analyst Erika Najarian.

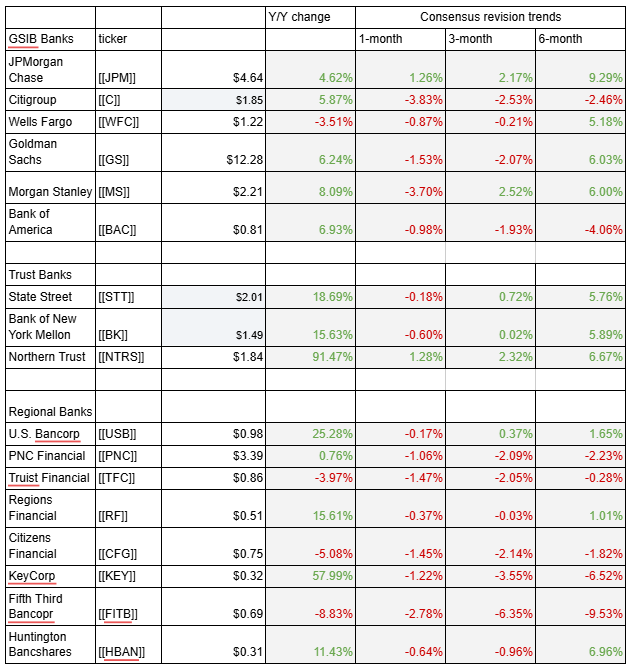

For Q1, note that most banks in the table are expected to see earnings rise from a year ago. However, for most banks, consensus estimates have been reduced in both the past month and three-month period.

As Evercore ISI analyst Glenn Schorr wrote in a note about Q1 earnings, "Not too much to get too excited about this quarter, with the only real hope for any earnings beats to be driven by really strong trading at the brokers."

"On the bank side, we see low growth in loan & deposit trends, stable enough expense & credit trends and strong trading results that will help offset the known pauses in M&A and IPOs," he said.

J.P. Morgan analyst Vivek Juneja expects:

- Q1 net interest income down at most banks Q/Q, on average, led by day-count impact;

- Loans remaining weak;

- Investment banking revenue slightly softer than expected, but trading revenue up solidly Y/Y;

- Wealth management fees up Q/Q;

- Mortgage banking revenue to benefit from higher origination revenue but still at low levels;

- Controlled core expense trends;

- Credit losses continuing to normalize and mixed loan-loss reserve trends; and

- Continued share buybacks at most banks.

J.P. Morgan reduced Q1 EPS estimates for most of the large-cap and large regional banks it covers. However, the firm increased its Q1 EPS for U.S. Bancorp (NYSE:USB) by a penny and kept Q1 estimates for Regions Financial (NYSE:RF) and Truist Financial (NYSE:TFC) unchanged. For FY2025, all EPS estimates were trimmed, with core EPS seen dropping 5% Y/Y.

Morgan Stanley's favored names heading into Q1 earnings are JPMorgan Chase (NYSE:JPM); rated Equalweight, Citigroup (NYSE:C), rated Overweight; and BNY (NYSE:BK), rated Overweight.

J.P. Morgan favors the global systemically important banks heading into Q1 over regionals. Citigroup (NYSE:C) should benefit near term on higher trading revenue. Juneja's Overweight names include: Bank of America (NYSE:BAC), Fifth Third Bancorp (NASDAQ:FITB), PNC Financial (NYSE:PNC), and Huntington Bancshares (NASDAQ:HBAN).

Evercore ISI's Schorr likes BNY (NYSE:BK) due to its conservative guidance. Meanwhile, JPMorgan Chase (NYSE:JPM) and Bank of America (NYSE:BAC) are "best-in-breed" consumer and commercial banks that have upside to a resolution of economic turmoil.

UBS's Najarian is focused on stocks with long-term tailwinds, including Wells Fargo (NYSE:WFC) and Capital One Financial (COF). She flags notable potential stock movers in response to Q1 earnings to be Bank of America (BAC), Citigroup (C), American Express (AXP) and KeyCorp (KEY).

Bank earnings estimates and revision trends (Seeking Alpha, CapIQ)

Earnings Calendar

Friday, April 11: premarket — JPMorgan Chase (JPM), Wells Fargo (NYSE:WFC), Morgan Stanley (NYSE:MS), BlackRock (BLK), Bank of New York Mellon (BK)

Monday, April 14: premarket — Goldman Sachs (NYSE:GS); after market close — Pinnacle Financial Partners (PNFP)

Tuesday, April 15: premarket — Bank of America (BAC), PNC Financial (NYSE:PNC)

Wednesday, April 16: premarket — U.S. Bancorp (NYSE:USB), First Horizon (FHN), Citizens Finanical (CFG); after market close — Synovus Financial (SNV)

Thursday, April 17: premarket — American Express (AXP), Blackstone (BX), Charles Schwab (SCHW), Truist Financial (NYSE:TFC), State Street (NYSE:STT), Huntington Bancshares (NASDAQ:HBAN), Regions Financial (NYSE:RF), KeyCorp (KEY), Ally Financial (ALLY); after market close: — Western Alliance Bancorporation (WAL)

Friday, April 18: Comerica (CMA)

Monday, April 21: after market close — Wintrust Financial (WTFC), Zions Bancorpration (ZION), Cadence Bank (CADE)

Tuesday, April 22: premarket — Synchrony Financial (SYF); after market close — Capital One Financial (COF), East West Bancorp (EWBC), Old National Bancorp (ONB)

Wednesday, April 23: after market close — Discover Financial Services (DFS)

Thursday, April 24: after-market close — SouthState (SSB), Webster Financial Corp. (WBS)

More on Goldman, Wells Fargo, etc.

- Goldman Sachs Earnings Preview: Concerns Over Deal Activity And Management Fees

- I'm Cautious On Wells Fargo Heading Into Q1 Earnings

- Goldman Sachs: High-Caliber Financial Powerhouse Trading At A Discount

- Bank of New York Mellon Q1 2025 Earnings Preview

- U.S. bank stocks jump on back of Trump's tariff pause