SA Sentiment: What's currently the biggest portfolio risk?

Seeking Alpha News (Thu, 27-Mar 9:02 AM)

Geopolitical and trade tensions continue to escalate, with ongoing wars and tariff threats fueling broader uncertainty in financial markets and economies around the world.

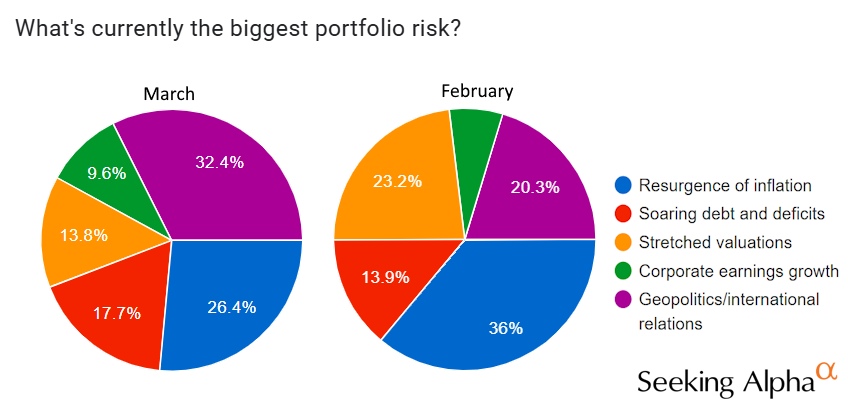

According to this month’s Sentiment Survey, which received more than 1,000 responses, a plurality of respondents now believe geopolitics and international relations pose the biggest portfolio risk (32% in March vs. 20% in February).

Resurgence of inflation continues to be a major concern, although fewer Seeking Alpha readers think it’s the top portfolio risk (26% in March vs. 36% in February).

Seeking Alpha

"The world and global economy are undergoing profound shifts and visibility is poor," Samy Chaar, chief economist at Lombard Odier, recently noted. "We think the best portfolio response is a high degree of portfolio diversification, supported by higher liquidity that allows us to deploy capital as soon as conditions warrant adding risk again."

SA analyst Leo Nelissen is sticking to his strategy of doubling down on undervalued companies built to last decades. "Political noise and short-term trading dominate headlines, but successful investing means ignoring hype and sticking to quality-forever holdings."

Danil Kolyako also recommends adding hedging tools, like these ETFs, to portfolios to manage potential market volatility in light of the changing tariff landscape.