Global recession from a trade war is seen as top market tail risk, BofA survey finds

Seeking Alpha News (Tue, 15-Apr 10:13 AM)

A potential trade war ignited by the policies of President Donald Trump’s administration—and the threat of a resulting global recession—has emerged as the top market tail risk, according to Bank of America's latest Global Fund Manager Survey. The findings highlight growing concern among global investors about geopolitical tensions and their ripple effects on financial markets.

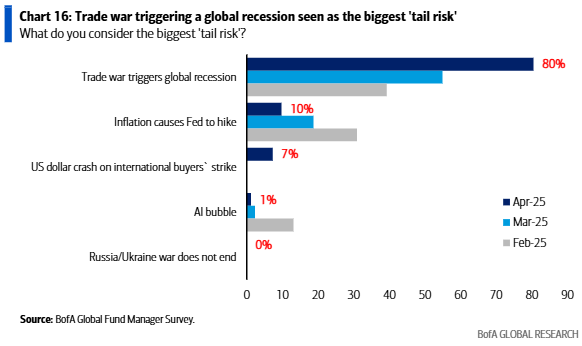

A striking 80% of fund managers surveyed identified a trade war leading to a global recession as the most significant tail risk facing markets today. This marks the highest level of consensus around a single risk factor since BofA began conducting the survey 15 years ago.

Beyond the looming threat of a trade war, other concerns were also on fund managers' radar, albeit to a far lesser extent. Inflationary pressures prompting aggressive interest rate hikes by the Federal Reserve ranked as the second-highest tail risk, garnering 10% of responses.

Meanwhile, 7% of participants cited a potential crash in the U.S. dollar—triggered by a foreign buyers’ strike—as a key threat. Only 1% of respondents pointed to a possible bubble in artificial intelligence as the greatest market risk.

The sharp focus on trade and recession fears underscores how geopolitical instability is increasingly shaping investor sentiment, especially as markets attempt to navigate a fragile post-pandemic recovery and shifting central bank policies.

Below is a chart provided by Bank of America highlighting the distribution of tail-risk concerns among fund managers:

Fund Manager Survey (BofA)

Market Tracking ETFs: (NYSEARCA:DIA), (NYSEARCA:DDM), (NYSEARCA:DOG), (NYSEARCA:DXD), (NYSEARCA:SDOW), (NYSEARCA:SPY), (NYSEARCA:VOO), (NYSEARCA:IVV), (NYSEARCA:RSP), (NYSEARCA:SSO), (NYSEARCA:UPRO), (NYSEARCA:SH), (NYSEARCA:SDS), (NYSEARCA:SPXU), (NASDAQ:QQQ), (NASDAQ:QQQM), (NYSEARCA:QLD), (NASDAQ:TQQQ), (NYSEARCA:QID), and (NASDAQ:SQQQ).

More on markets

- Apollo critiques 60/40 portfolio as returns fall short since 2022

- Will The Plunging Dollar Lead To A Recession And Bear Market

- Air travel slumps as Apollo points to a noticeable decline in airports traffic

- Flight to safety: 10 dividend stocks with strong SA quant grades amid market volatility

- Trump’s 90-day tariff pause is not as helpful as it sounds, Citi says