Retailers: Seeking Alpha Analysts vs. Wall Street

Seeking Alpha News (Tue, 15-Apr 9:01 AM)

Seeking Alpha

The retail sector has taken quite some beating on account of the uncertainty plagued by the tariff-related announcements. However, the recent 90-day pause on reciprocal tariffs for all countries, except China, has helped the sector get some respite.

Interestingly, retail sales grew moderately in March after two straight months of declines as consumers were stocking up to get ahead of tariffs.

"With the economic outlook unclear and the situation fluid, consumer sentiment is weakening, and many consumers are shifting disposable income into savings," noted an industry body CEO.

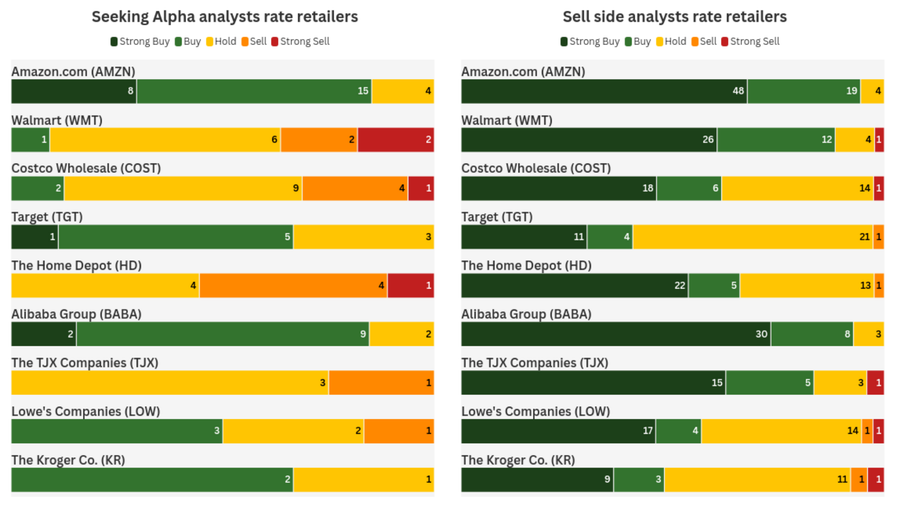

In such a prevailing atmosphere, Wall Street analysts have appeared to be more favorable toward these stocks than Seeking Alpha analysts.

Looking at the chart above, Seeking Alpha analysts appeared cautious on Walmart (NYSE:WMT), Costco Wholesale (NASDAQ:COST), Home Depot (NYSE:HD), and TJX Companies (NYSE:TJX), while the sell side gave them a bullish mandate. The opposite was the case for Target (NYSE:TGT) which was rated favorably by SA compared to Wall Street.

Amazon (NASDAQ:AMZN) and Alibaba Group (NYSE:BABA) were rated mostly in green by both sides. While Kroger (NYSE:KR) and Lowe's Companies (NYSE:LOW) received a mix of opinions from the analysts.