Short interest bets for bigger consumer staple names fall in March

Seeking Alpha News (Tue, 15-Apr 10:13 AM)

The short interest on 20 out of 38 consumer staple stocks—part of the Consumer Staples Select Sector SPDR Fund (XLP)—increased at the end of March vs. last month. The remaining 18 stocks saw a fall in their short interest.

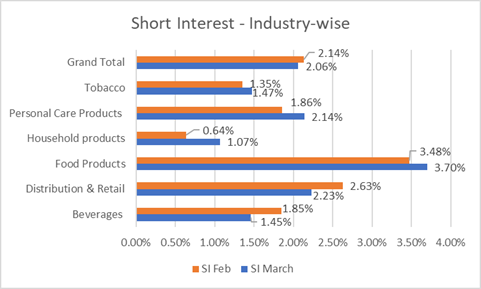

Industry-wise, short interest bets moved higher for 4 out of 6 sub-sectors, and the grand total of short interest also increased to 2.06% in March from 2.14% in February.

Industry Analysis:

In the consumer defensive/staples sector, Food Products remained the topmost shorted industry, like the last few months, with an average short interest of 3.70% vs. the previous month's 3.48%.

Seeking Alpha

The Distribution & Retail industry had the second-highest short interest of 2.23% at the end of March, vs. 2.63% last month.

Short interest in the Household products segment was lowest 1.07% vs. 0.64% prior. Beverages was the second-lowest segment, with a short interest of 1.45% vs. 1.85%.

Personal Care Products short interest increased to 2.14% from 1.86%, while that for Tobacco was 1.47% vs. 1.35% prior.

Short interest, which could potentially be an indicator of pessimism, calculates the number of shares sold against the company's float. (Short Interest % = Number of Shares Sold Short ÷ Stock Float). To note, consumer staples often underperform in rising markets but beat the falls.

"The ratio of consumer staples to cyclical sectors and market breadth indicators signal economic problems and potential recession despite no clear signs of recession yet." wrote Seeking Alpha contributor Hugo Ferrr.

"Historically, consumer staples stocks tend to outperform in times of uncertainty. Regardless of what is going on with the world, people have to buy everyday products like food and beverages, personal hygiene tools, and cleaning supplies. In addition, (most) staples stocks tend to trade at reasonable valuations and have fairly predictable earnings, meaning that they gain appeal as a safe harbor when folks want to rotate out of higher-valued or more speculative stock holdings. Finally, staples tend to offer strong dividend yields, making them an appealing income option that can keep delivering the goods even during a recession." Seeking Alpha Investing Group Leader Ian Bezek explained.

Least shorted stocks:

Philip Morris International (NYSE:PM): 0.58% vs. 0.62% last month

Procter & Gamble (NYSE:PG): 0.73% vs. 0.84%

Walmart (NYSE:WMT): 0.85% vs. 0.87%

Coca-Cola (NYSE:KO): 0.88% vs. 1%

Kimberly-Clark (NYSE:KMB) 1.13% vs. 1.67%

To note, the least shorted consumer staple stocks are bigger players in the sector. All the above names see their short interest fall in March compared to the previous month.

Most shorted stocks:

- Brown-Forman (NYSE:BF.B) 9.96% vs. 8.71%

- Campbell Soup (NASDAQ:CPB): 8.95% vs. 8.79%

- Molson Coors Beverage (NYSE:TAP) 7.72% vs. 6.46%

- Dollar Tree (NASDAQ:DLTR) 7.75% vs. 5.12%

- Lamb Weston (NYSE:LW) 5.97% vs. 7.28%

The S&P 500’s consumer staples sector ETF (NYSEARCA:XLP) lost 1.7% in March, compared to a broader S&P 500 ETF Trust (NYSEARCA:SPY) loss of 5.75%. Noting, consumer staples (NYSEARCA:XLP) often get attention in a risk-off scenario.

ETFs to tab consumer staples: (NYSEARCA:VDC), (NYSEARCA:IYK), (NYSEARCA:FSTA), (NYSEARCA:KXI), (NYSEARCA:FXG), (NYSEARCA:RSPS).

ETFs to tab market volatility (VIX): (BATS:VXX), (BATS:VIXY), (BATS:VMAX), (VXZ), (BATS:VIXM)

More on Consumer Staples

- Yes, Bear Market Risk Has Skyrocketed Dramatically

- XLP: I Like Consumer Staples, But I'm Not Buying This ETF

- Top consumer staples gainers and losers during tariff frenzy week

- BMO Capital Markets cuts its S&P year-end target amid tariff turbulence

- Seeking Alpha’s Quant Rating on Consumer Staples Select Sector SPDR® Fund ETF