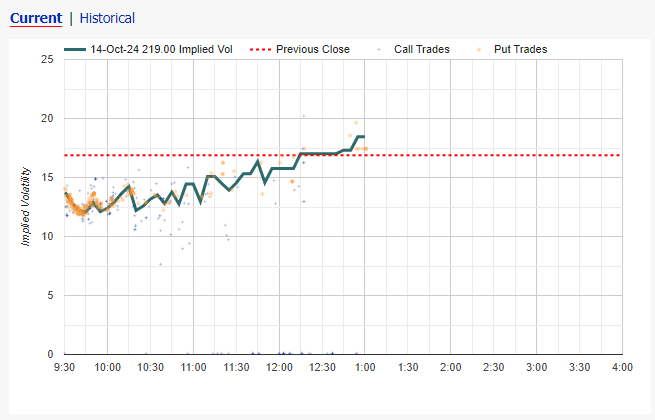

Get an in-depth look at the implied volatility (IV) movements for a specific option throughout the trading day. The chart uses the midpoint IV of the bid and ask quotes, enabling you to track changes in IV and identify trends.

Additionally, you can switch to longer historical IV charts to view how this option's IV has evolved over time. This feature, combined with option volume trends, provides deeper insights into trading ranges, liquidity, and the dynamics of implied volatility across different periods.

This feature helps traders better understand the relationship between IV movements and trading activity, supporting more informed decision-making regarding price discovery, liquidity management, and assessing IV ranges for the option.