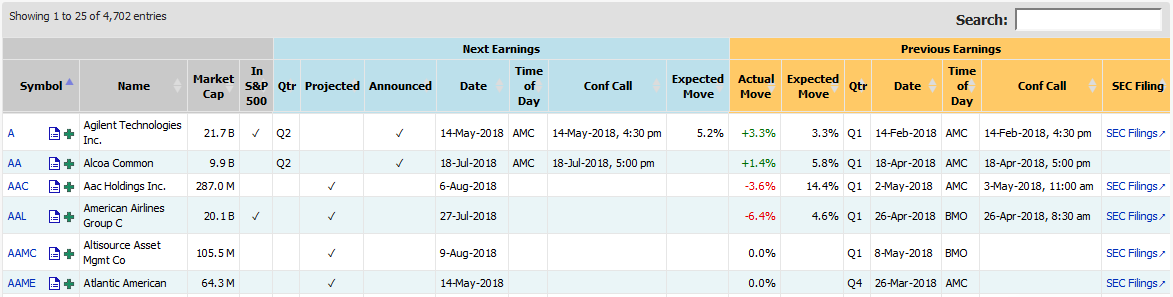

The Forward-Looking Earnings Dates page provides an easy way to find upcoming earnings announcements for publicly traded companies and get an idea of how the stock price performed around the time of the previous earnings announcement.

Stock Traders can use this page to find opportunities to make a directional trade in a stock just ahead of earnings announcements based on fundamental research, analyst expectations and other factors such as call/put open interest or trade volume ratios.

Options traders can use this page to determine whether an earnings announcement is expected to occur on or before expiration. Earnings announcements can affect the price of a stock and related options.

For both the next earnings announcement and previous announcement, the date, time of day (before market open or after market close), conference call date/time, fiscal quarter and the expected price move (based on implied volatility) is provided. The actual price move and SEC Filing link is provided for the previous earnings announcement.

Since the earnings announcements occur outside of market hours, the time of day of the earnings announcement is provided to allow the trader to prepare for the announcement during market hours preceding the announcement. For example, if the announcement is after market close, it may be wise to make hedging trades shortly before the end of the trading day. Conversely if the announcement is scheduled for before market open, hedging has to be done before the end of the previous trading day.

The conference call date/time is significant because material information could be disseminated by company management during the call which could affect the stock price.

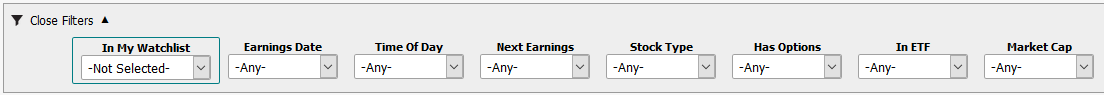

Filters can be combined to zero in on the desired earnings events. Possible uses for filters are:

The Forward-Looking Earnings Dates Report is fully functional for premium subscribers.