Go to any product (for example, search for AAPL) > Under the Tools section click Seasonality (or Click Here for the AAPL Seasonality Monitor)

You can use this report to spot Seasonal stock patterns that display Strength and Weakness by calendar month. The report also calculates absolute returns and max min movements to gauge which periods tended to have more or less volatile recurrences . Compare holding periods with % Win Rates, Average Returns, Median Returns.

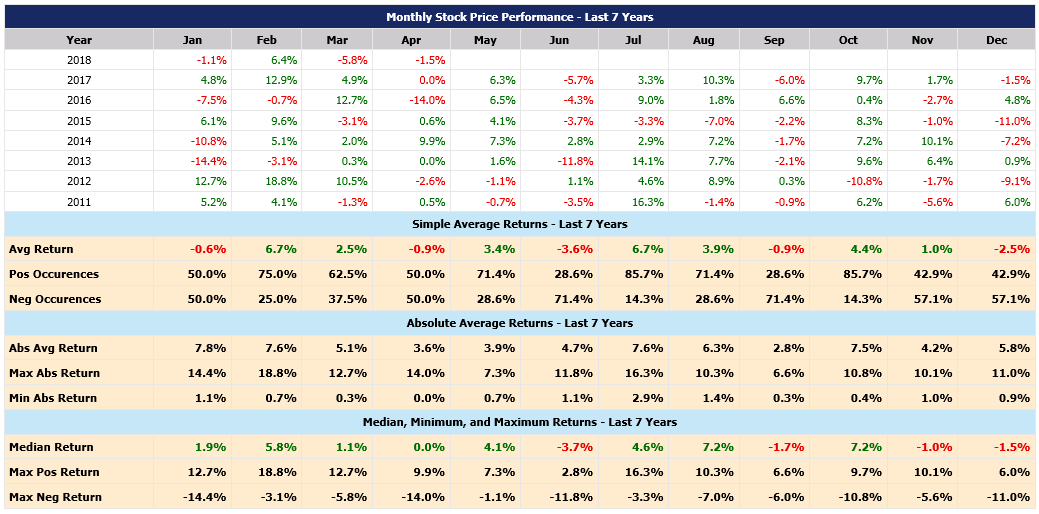

The screenshot below is an example of the insights you would see from the Seasonality Monitor By Calendar Month.

The system will automatically display the calendar month with the highest seasonal strength and weakness (with an occurrence rate above 50%), based on the number of positive and negative returns that occurred historicallly over the years of available data.

The screenshot below shows the detailed results of the seasonality monitor.

The table organizes calendar returns by year and month to spot trends and patterns. At the bottom of the data table, results are summarized for the calendar months by Average returns, % positive and % negative returns for frequency. Absolute (Abs) Avg, Abs Max, and Abs Min Returns (these values are converted to positive before calculations, i.e. Absolute Value) to gauge the magnitude of the moves in order to spot higher and lower volatility periods. The Median, Minimum and Maximum Returns section displays the median return to be used as a comparison to the average return because the average return can be skewed due to outliers. Max and Min show the best and worst returns for the calendar period.