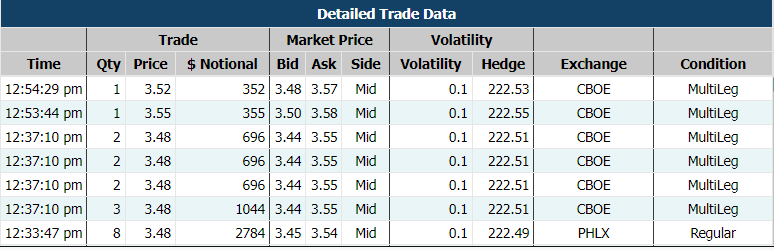

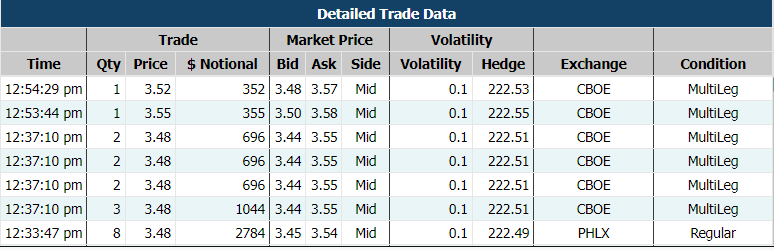

Time And Sales for an Option Contract

The Time And Sales feature on Market Chameleon offers a detailed view of all trades executed in a specific option contract throughout the day. This tool provides granular insights into each trade’s dynamics, helping traders analyze market activity in real time.

Key Insights:

-

Timestamped Trades: View the exact time each trade occurred, giving you a precise sequence of events.

-

Trade Details: Access information about the quantity, price, and notional value of each trade.

-

Bid-Ask at Trade Time: See the market’s bid and ask prices when the trade was executed, offering clarity on where the trade occurred within the spread.

-

Side of Market: Understand whether the trade executed on the bid or ask side, helping you gauge market sentiment.

-

Implied Volatility: Track the implied volatility (IV) level of each trade to study how volatility evolved throughout the day.

-

Hedge or Reference Price: Review the underlying asset’s price at the time of the trade to assess market conditions and potential hedging strategies.

-

Exchange & Trade Conditions: Identify the exchange where the trade occurred and any special conditions, such as multi-leg or contingent trades.

This feature provides traders with valuable tools to:

-

Spot unusual trading activity or patterns, such as trade clustering at specific times.

-

Analyze trade dynamics, including volatility shifts, spread movements, and multi-leg strategies.

-

Monitor liquidity and execution quality by comparing trades against market conditions at the time.

With Market Chameleon's Time & Sales feature, traders gain a comprehensive view of how trading in a particular option unfolds, offering insights that enhance their ability to make informed decisions and react to market developments.