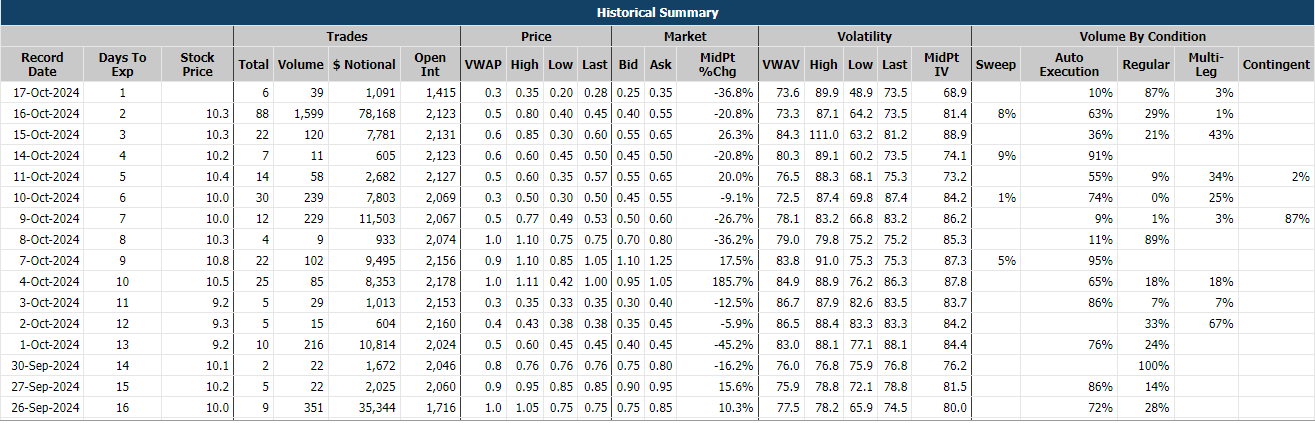

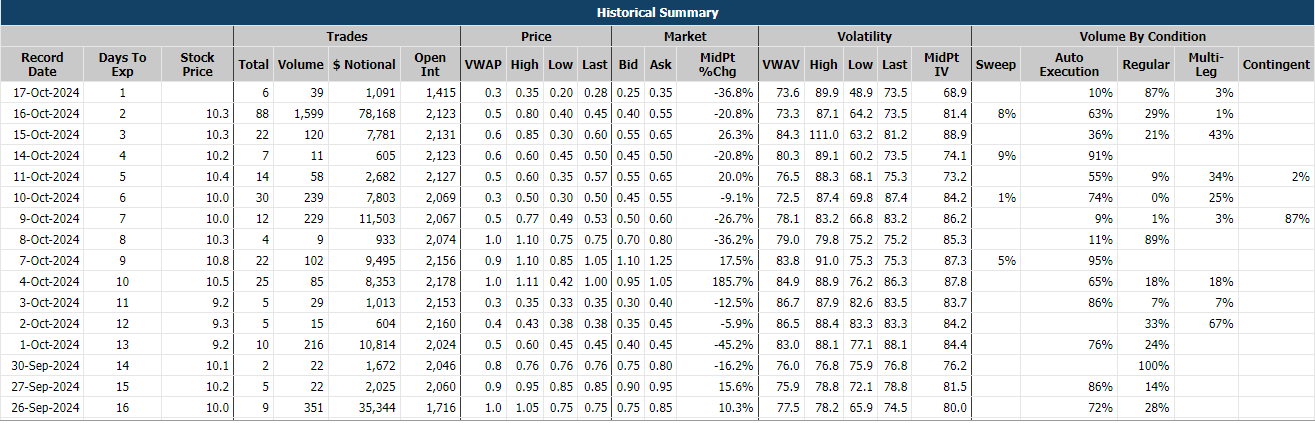

Option Contract Historical Data Analytics

The Historical Data page provides a comprehensive overview of how a specific option contract has traded over time, offering valuable insights for traders and analysts. The table format makes it easy to track the option's historical performance, prices, volumes, and open interest on a day-by-day basis.

Data Columns and Structure:

Data Fields:

-

Date: The specific trading day being recorded.

-

Days to Expiration: Displays the number of days left until the option's expiration, providing context for time-sensitive strategies.

-

End-of-Day Stock Price: The underlying stock’s closing price for that day, serving as a reference point for the option's performance.

Trade Summary Section:

Data Fields:

-

Number of Trades: The total number of transactions for the option on that day, showing the level of trading activity.

-

Volume: The total number of option contracts traded, indicating market participation and liquidity.

-

Notional Value ($): The total dollar value of the traded contracts, providing a sense of the financial magnitude of the trades.

-

Open Interest (Start of Day): The total number of open contracts at the beginning of the day, helping assess if new positions are being added or existing positions are being closed.

Usefulness of the Data:

This historical option data allows traders to:

-

Gauge Liquidity: Monitor daily trading activity to assess the option’s market depth and ease of execution.

-

Identify Market Interest: Understand demand patterns by tracking how many new or closing positions were established through open interest data.

-

Spot Unusual Activity: Quickly scan for days with abnormal volume or trading spikes, signaling potential market events or opportunities for deeper investigation.

-

Track Position Building or Reduction: Analyze open interest trends to see if traders are building up or unwinding positions in the option, providing insight into market sentiment over time.

This data equips traders with the tools needed to spot trends, evaluate liquidity, and identify opportunities or risks in the market, supporting more informed trading decisions.

Price Section:

The

Price section provides detailed information on how the option traded throughout the day, helping traders analyze the price levels, liquidity, and volatility.

Data Fields:

-

VWAP Price (Volume-Weighted Average Price): This shows the average price at which the option traded throughout the day, weighted by volume. It reflects the price at which the most activity occurred, giving a clearer picture of where the majority of the trading interest was concentrated.

-

High Price: The highest price at which the option traded during the day.

-

Low Price: The lowest price at which the option traded during the day.

-

Last Price: The final price at which the option was traded before the market closed.

Usefulness of the Price Data Section:

-

Price Range Analysis: The high and low prices reveal the trading range for the day, helping traders understand the day’s volatility.

-

Comparing to VWAP: Traders can compare the high, low, and last prices against the VWAP to assess how far the trades deviated from the average market activity. If prices are consistently above or below the VWAP, it may indicate momentum or a shift in market sentiment.

-

Assessing Liquidity: VWAP, combined with the volume data, gives traders insight into the liquidity and ease of execution for that option on a particular day. A narrower range around VWAP suggests stability, while a wider range could signal thinner markets or increased volatility.

-

Volatility Insights: Days with large differences between the high and low prices may indicate heightened volatility, providing opportunities or risks depending on the trader's strategy.

This data allows traders to identify key patterns, determine liquidity, and gain insights into the option's behavior throughout the trading session, supporting more precise trading strategies.

Market Section:

The

Market section provides the latest snapshot of the option's

Bid, Ask, and Midpoint prices, along with the change from the previous day’s close. This data is essential for understanding how the option's value evolves, even without trading activity, and for gauging market liquidity.

Data Fields:

-

Bid Price: The highest price a trader is willing to pay to buy the option at that time (the buy-side quote).

-

Ask Price: The lowest price a trader is willing to accept to sell the option at that time (the sell-side quote).

-

Midpoint Price: The midpoint between the bid and ask prices, often used as the reference value (mark-to-market) to assess the option’s fair value.

-

Midpoint Change from Previous Close: The change in the midpoint price from the previous day’s close, showing how the value of the option has shifted since the last trading session.

Usefulness of Market Data:

-

Tracking Value Changes Without Trades: Since options are derivatives, their value fluctuates due to factors like time decay, changes in the underlying stock price, and implied volatility. Even without actual trades, the bid and ask prices show the current market sentiment, helping traders understand how the option’s value evolves over time.

-

Bid-Ask Spread for Liquidity: The difference between the bid and ask prices indicates the liquidity of the market. A tighter spread signals higher liquidity, meaning the option can be easily traded with minimal price impact. A wider spread suggests lower liquidity, potentially making it more challenging to execute trades at favorable prices.

-

Industry Standard Marking: The midpoint price is the industry standard for mark-to-market valuation, offering a reliable estimate of the option’s value between the bid and ask. By comparing the midpoint change from previous days, traders can track historical value trends and gain insights into market sentiment.

-

Understanding Trading Dynamics: The bid and ask quotes represent firm, tradeable prices, meaning they reflect what traders are actively willing to buy or sell for at that moment. Monitoring these changes provides insights into the option’s market dynamics.

This data helps traders assess not only the historical value changes but also the

current market conditions and liquidity, enabling better decision-making in both strategy execution and risk management.

Implied Volatility Section:

The

Implied Volatility (IV) section provides key metrics that help traders understand how the market priced the option's volatility throughout the day. Implied volatility reflects the market's expectations of future price movement and serves as a crucial input for option pricing models.

Data Fields:

-

VWAV (Volume-Weighted Average Implied Volatility): The average implied volatility across all trades, weighted by volume. This shows where the majority of trading activity concentrated in terms of volatility, offering a more accurate reflection of market sentiment.

-

High Implied Volatility: The highest implied volatility at which the option traded during the day, signaling peaks in market expectations for future volatility.

-

Low Implied Volatility: The lowest implied volatility at which the option traded during the day, showing the minimum volatility expectations observed.

-

Last Implied Volatility: The implied volatility of the final trade executed during the session.

-

Last Midpoint IV: The implied volatility based on the midpoint of the final bid and ask prices. This serves as a reference to see where the implied volatility stands after the day’s trading activity.

Usefulness of Implied Volatility Data:

-

Benchmark for Price Discovery: Implied volatility plays a vital role in option pricing. The VWAV provides a benchmark for where the option was most actively traded in terms of volatility, giving traders insight into the relative premium of the option compared to its theoretical value from the options pricing model.

-

Tracking Volatility Range: The high, low, and last implied volatilities provide a full view of the range in which volatility traded during the day. By comparing these metrics to the VWAV, traders can identify if volatility was consistently above or below the average, indicating periods of heightened or subdued activity.

-

Assessing Market Sentiment Changes: The Last Midpoint IV shows the implied volatility based on the most recent market snapshot. Traders can compare this against the VWAV and the last trade IV to determine if the bids and offers have drifted from the traded values, helping them assess how market sentiment evolved throughout the day.

-

Spotting Volatility Shifts: Significant deviations between the high and low volatility levels can signal changing market expectations or increased uncertainty. Tracking these shifts allows traders to respond to potential opportunities or risks as they emerge.

This data provides traders with the tools to

evaluate the option's premium, identify shifts in volatility expectations, and monitor the latest market conditions, enabling them to make informed trading decisions.

Volume by Trade Condition Section:

The

Volume by Trade Condition section breaks down the option's trading volume into percentages based on the type of trade executed. This provides deeper insights into the nature of the trading activity, helping traders understand how the option was used by market participants.

Data Fields:

-

Single-Leg Trades:

- Sweep Orders (%): This represents the percentage of volume executed through intermarket sweep orders (ISOs), which are aggressive orders designed to bypass the NBBO (National Best Bid and Offer) and grab liquidity across multiple exchanges simultaneously. These orders reflect urgency and high demand for liquidity.

- Auto-Execution (%): The percentage of trades that were automatically executed through the exchange’s matching engine without manual intervention. These trades reflect fast-moving, automated trading activity.

- Regular Trades (%): The percentage of single-leg trades executed under standard trading conditions without any special designations, showing traditional order flow.

-

Multi-Leg Trades (%): This metric shows the percentage of volume from trades where the option was part of a multi-leg strategy (e.g., spreads or combos). This indicates that traders used the option as part of a more complex strategy rather than in isolation.

-

Contingent Trades (%): The percentage of trades tied to stock trades, such as delta hedging or buy-write strategies, where the option trade is contingent upon an associated equity trade. These trades reflect more sophisticated trading strategies that involve both the option and the underlying stock.

Usefulness of Volume by Trade Condition Data:

-

Understanding Trading Behavior: This breakdown helps traders see how options are being used—whether as single-leg trades, part of spreads, or as hedging tools tied to stocks. It provides insights into how end-users are deploying options in the market.

-

Identifying Market Strategies: The multi-leg volume highlights how much of the trading activity is attributed to strategies like spreads or combinations. This can indicate the degree of strategic trading beyond simple buying or selling of calls and puts.

-

Assessing Liquidity and Urgency: A high percentage of sweep orders reflects aggressive attempts to capture liquidity, often indicating urgency or heightened demand. Auto-execution volume shows the portion of trades driven by algorithms or high-frequency trading.

-

Tracking Hedging Activity: The contingent trade volume reveals how much of the activity is linked to stock transactions, such as delta hedges or buy-write strategies, providing insight into how traders are managing risk and exposure.

This data gives traders a clearer picture of the

type of trading activity, helping them

interpret volume trends more accurately and understand how various market participants are interacting with the option contract.