Introducing our Multi-Leg Trades Options Spread Screener, an advanced tool designed to simplify and enhance your options trading experience. This screener is specifically crafted to scan, detect, and analyze multi-leg option trades, allowing you to gain deep insights into the strategies being deployed in the market without the need to sift through vast amounts of data manually. Click here to go to the Multi-Leg Option Trades Screener

Here are the key features and how it will translate into actionable benefits for your options trading.

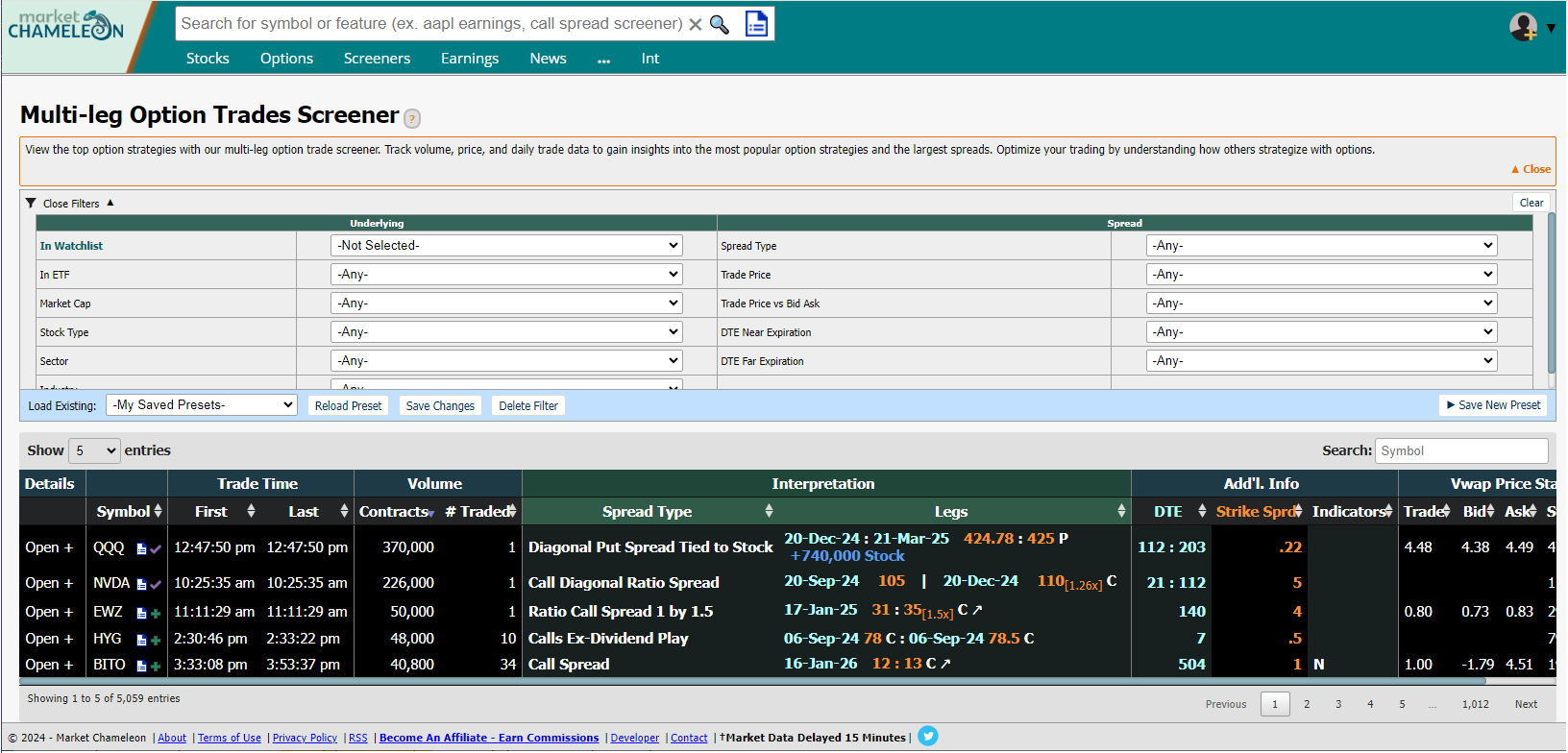

Our screener meticulously scans option trades and identifies those that are part of multi-leg strategies. By assembling and stitching together data from individual trades, it reveals the underlying strategies, such as call spreads, calendar spreads, butterflies, and more.

No more wasting hours trying to piece together trades manually. With our tool, you can instantly see how traders are utilizing options through multi-leg trades, helping you focus on analyzing strategies rather than gathering data.

Easily screen for different strategies or stocks to detect which multi-leg trades are actively being used. Whether you're interested in specific stocks or certain types of spreads, our tool provides the flexibility to refine your search and zero in on what matters to you.

The screener aggregates unique spreads that trade throughout the day, providing a comprehensive view of their activity. You can see how many times a spread has traded and at different prices, offering a clearer picture of market sentiment and trading patterns.

For each detected spread, our screener displays detailed information including the legs involved, prices traded, markets, volume, and reference stock prices. This level of detail ensures you have all the data you need to make informed trading decisions.

Quickly spot the largest volume spreads and the stocks in which they are traded. This feature helps you identify significant market moves and trading opportunities.

Click on additional details to view granular trade information and perform in-depth analysis. You can also detect if the same spread has traded historically, giving you context and insight into recurring market behaviors.

Our screener is designed for traders who want to stay ahead of the curve by quickly detecting, analyzing, and gaining insights into options spreads and strategies. With this tool, you can effortlessly monitor market activity, understand trading strategies, and make better-informed decisions.

Explore the Multi-Leg Trades Options Spread Screener today and see how it can transform your trading strategy by providing you with the data and insights you need to succeed in the fast-paced options market.