The stock market comprises various trader cohorts, from small retailers to large institutions. Trades with large volumes that exceed hundreds of thousands, and sometimes even millions of dollars, in single stock transactions, are not uncommon. Such massive transactions, made by larger institutions, are also called institutional trades, as they are handled by organizations that control substantial investment capital. Due to the sheer amount of capital involved with these large dollar volume trades, institutional investors can influence the market.

Market Chameleon detects large volume burst trades that are significantly larger than standard large trades, exceeding the average large trade by three standard deviations.

Of course, it is important to note that large volume burst trades for large market capitalization stocks might appear different compared to similar trades for small market capitalization stocks. This happens primarily because small market capitalization equity securities do not get as much institutional cash flow toward it. Knowing how to differentiate between them can be critical in helping you make better decisions.

To make your life easier, Market Chameleon keeps statistical benchmarks for each equity security based on its volume history. The result is a set of more accurate and actionable data you can use to inform your trading decisions.

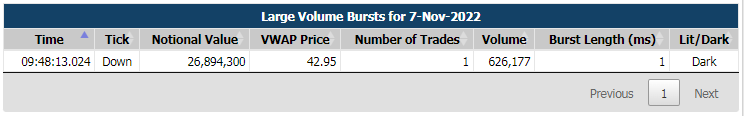

The table below shows a single large volume burst trade that is more than 3 standard deviations above an average large trade (specific to this particular security). The volume on this trade was 626,177. The typical large institutional trade in this security was nearly 200,000 shares, with a standard deviation of 45,000. This trade stands out as an unusually large trade.

Large Volume Trade > 3 Standard Deviations

Market Chameleon helps you track large dollar volume trades in both the dark pool and also on lit exchanges such as NASDAQ and NYSE.

Dark pools are privately organized financial forums or exchanges to trade securities that let institutional investors make massive trades without exposure until after they execute and report them. By keeping other investors in the dark through these pools, buy-side institutional investors enjoy pricing and cost advantages. It also lets institutional investors the ability to avoid others from running the book.

When these large traders cannot find liquidity in dark pool venues, they can move to the lit exchange and take the displayed liquidity by lifting the resting orders on the exchange’s limit order book.

Tracking unusually high-volume transactions in both avenues gives you a unique insight into a stocks trade volume.

Large volume trades can happen in one of two ways: Block trades that comprise a single large transaction or a series of multiple trades executed in quick succession.

Block Trades: Large trades can get matched up in a single transaction called a block trade. This can result from two large orders on opposite sides matched up in the dark pool and executed at a single price. Block trades can also be executed on regulated lit exchanges like the NYSE and NASDAQ, provided that an opposite side takes a large limit order in a single trade.

Multi-Trade Bursts: Market Chameleon looks for institutional traders who want to quickly execute a large volume of stock against the limit order book in quick succession. The executions would consist of many individual trades in a matter of milliseconds. The aggregate of the trades would amount to a large volume burst.

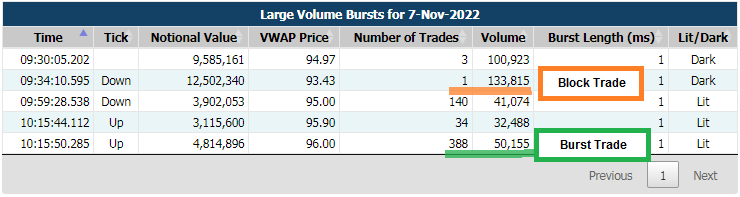

Below you'll see a comparison between large volume trades that are executed as a block and as a multi-trade burst. Market Chameleon was able to identify the multi-trade burst because all 388 of the trades were executed within the same 1 millisecond.

There are always two sides to any trade: A buyer and a seller. Market Chameleon keeps track of the price impact of the large trades to assess if the initiating trade stepped up to buy or stepped down to sell.

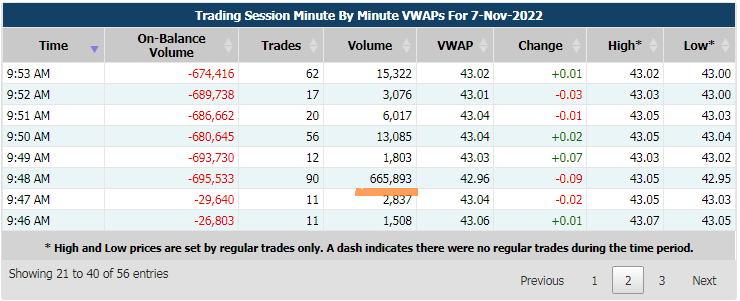

As a benchmark, Market Chameleon keeps track of all previous minute volume-weighted average prices (VWAPs) and compare them to the VWAP for the large volume bursts. If the large volume trade is on an uptick, Market Chameleon assumes that the trader must have bid up the stock and the buyer stepped up. The opposite would happen in a downturn. A seller would have to step down.

As you can see in the table below there was a huge trade at 9:48 am. The total volume for that minute was 665,893 while the typical volume is less than 15,000. If you notice the VWAP price in that minute was 42.96, which is a -9 cent downtick from the previous minute VWAP of 43.05. The assumption is that a seller stepped down to complete the execution.

Tracking large dollar volume trades shows you the bigger picture, allowing you to know the market activity of institutional investors who effectively influence the market with the sheer amount of capital they control. Knowing and understanding this flow of capital in the securities market can be essential for you to analyze overall sentiment, sector, and stock rotation properly. It can also indicate potential larger positions being built up by institutional investors, empowering you to leverage the moves to your advantage.