The ATM Straddle Performance report is designed to help you find option symbols that have had consistently undervalued (or overvalued) at-the-money straddles over an extended period of time.

Ideally a trader would use the report to enhance their options trading research and help generate ideas for positions to take on at-the-money option straddles. The report is fully functional for both Premium Total Access and Options Trader subscribers.

From the main menu go to Options > Week-by-Week ATM Straddle Performance (or click this link).

The report deals directly with at-the-money option straddles. If you are not familiar with straddles, you can learn about them here .

At a base level, the report tries to answer the question: If I bought a straddle at a certain point in time and held it until the end of the week (or until it expired), would that straddle have gained value?

To do this, what we do is sort through millions of option market snapshots to find the value of option straddles at the beginning of a week (typically Monday morning), and track the performance of that straddle until the end of the week (typically Friday market close). We use each symbol's nearest expiration (sometimes called the "Front Month") -- so that if we are looking at straddles from the week of Monday, February 1st through Friday, February 5th, we will use the nearest expiration on or after February 5th.

We find the value of the option straddle at the beginning of the week (the "Opening"), and treat this as if it would be the time when the theoretical trade would be purchased. Then, the end of the week (the "Closing") is treated as if it is the time when the theoretical trade is then sold back. If the straddle gains value from Opening to Closing, this is considered a "win" for the week. You can use the report to find which symbols produce the highest "win" rates within an extended period of time.

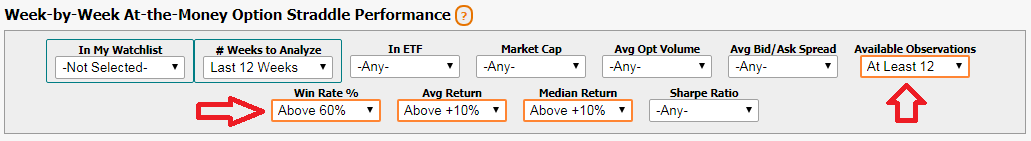

We track these results over the most recent number of weeks indicated on the report. The base report shows the last 12 weeks, however, with the filter, you can change it to view the last 6 weeks, last 3 weeks, last 2 weeks, or last 1 week only.

An important concept that goes hand-in-hand with option trading is delta-hedging. To learn more about delta, visit this page. To learn more extensively about delta-neutral trading, visit this page.

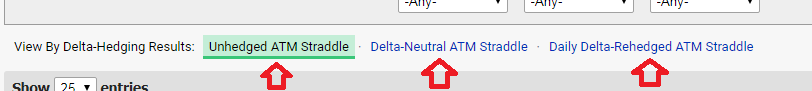

Within the ATM Straddles Performance report, MarketChameleon provides the ability to toggle between different delta-hedging concepts to see how different techniques could affect results.

Unhedged ATM Straddle is a naked option straddle, 1 call and 1 put on the same at-the-money strike, with no additional stock traded. The resultant value is based solely on the value of the options themselves. Any net delta made from the trade is left untouched.

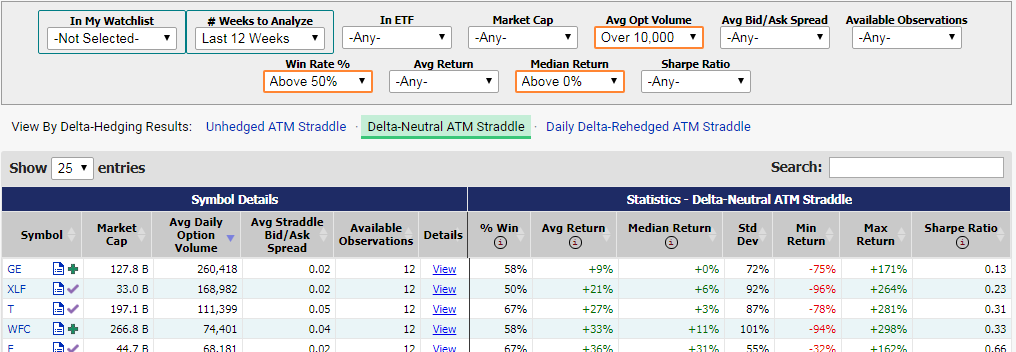

Delta-Neutral ATM Straddle is based on hedging the straddle's initial net delta to neutral, and then leaving the trade untouched for the remainder of the week.

Daily Delta-Rehedging is based on hedging the net delta both initially at the "opening" of the trade, and then daily at the end of each day to neutralize the delta.

For techniques that include delta-hedging, the straddle return and the win rate would both be affected by the gain or loss in value of the underlying stock that results from hedging.

Below is a screenshot of where you can toggle between these choices on the report.

Below is a sample screenshot of the filters available for use on this report.

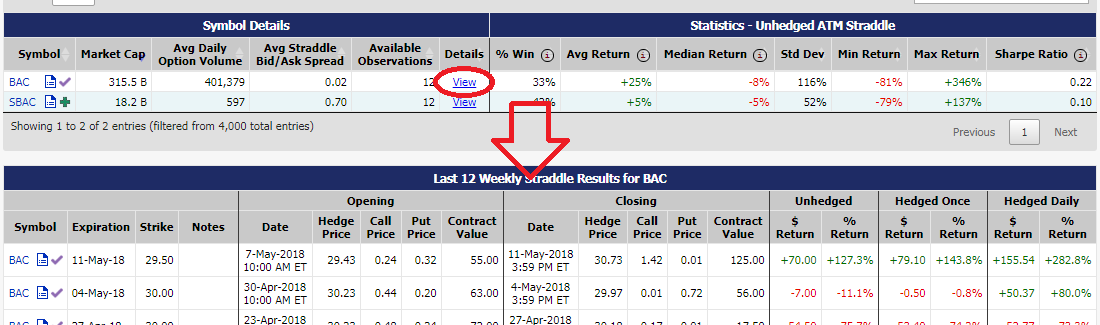

To view individual results by symbol, showing the week-to-week straddle performance, click on the link that says "View" on the desired row of the table. At the bottom of the page you'll see the breakdown for up to the last 12 weeks.

This table shows you the Expiration and Strike for the specified straddle, and compares the "Opening" values to the "Closing" values. You can see Notes, which would indicated whether there was an earnings date sometime within the week specified. Towards the right of the table you'll see the different returns based on the available hedging techniques used. $ Return shows the raw return in the strategy based on dollars (the theoretical trade assumes the purchase of 1 long call and 1 long put), while the % Return shows that value in terms of percentage of initial straddle cost.