In several places throughout the site, we use a feature called Event-Driven Historical Insights to analyze trading before, during, and after notable market events. The goal is to see if there are detectable patterns in historical trading for either the stock price or certain option strategies, to help our users make better decisions about upcoming market events.

Jump to: Single-Symbol Analysis | Stock Pattern Screener

We've collected the events into four different event-type categories:

1. Price-Driven Events

2. Corporate-Driven Events

3. Market Economic Events

4. Exchange Holidays

This includes New Year's Day, Christmas Day, and the US federal holidays Thanksgiving, Memorial Day, Fourth of July, and Labor Day.

Before Timeframe Choices: You can view any of 2 Weeks Before, 1 Week Before, 3 Days Before, 2 Days Before, or 1 Day Before the selected event. The change in stock price would go from the start of that timeframe to the close immediately before the event day.

Full Day Move: The change in price from the closing price before the event to the closing price on the day of the event.

Day of Event Opening Gap: This is the opening gap or opening "jump" on the morning of the selected event, from the previous day's closing price to the opening price the day of the event.

Day of Event Open to Close: This is the "drift" in stock price from the open on the day of the event to the close on that same day. Sometimes, when the stock experiences a significant opening gap, it will drift back the opposite direction during the day -- kind of like a correction to a market overreaction.

After Timeframe Choices: You can view any of 1 Day After, 2 Days After, 3 Days After, 1 Week After, or 2 Weeks After the event. The change in stock price would go from the close on the day of the event to the end of the selected timeframe.

Note on Holidays: the markets are closed on exchange holidays, so we don't calculate full-day moves, opening gaps, or drifts open-to-close.

You can find a thorough analysis on the event driven insights for one symbol by visiting the report under each symbol's overview page. The menu item is on the left hand side under Tools.

There, you'll be able to view results for both Stock Price Performance and Trends and Option Values and Strategy Performance.

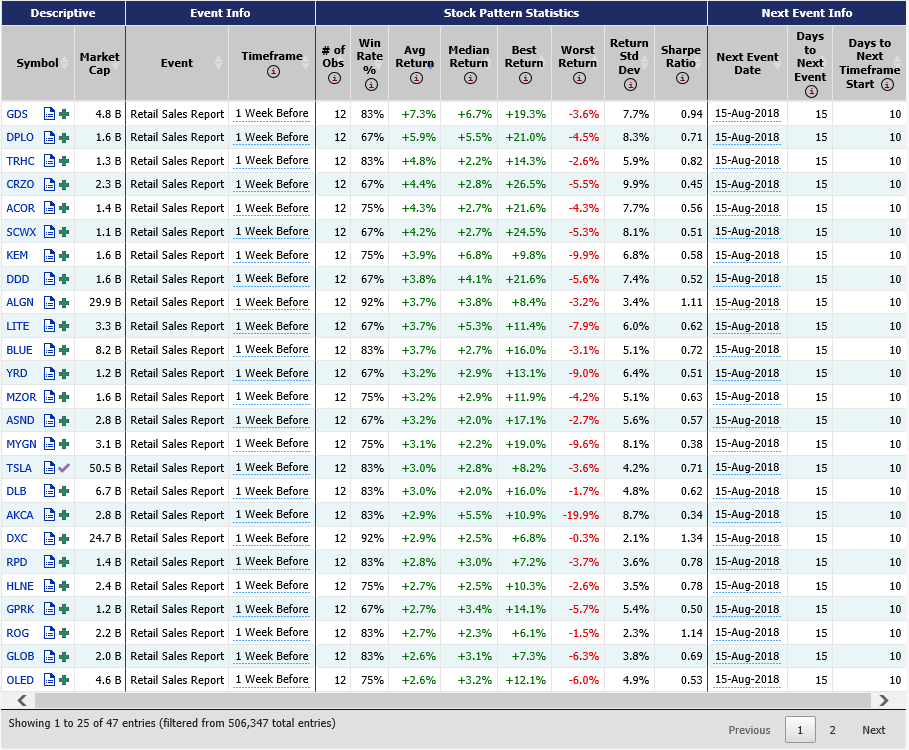

In addition to analysis for one symbol, you can view the stock price patterns as a screener, where you can compare results for all the stocks and timeframes we have available. Note: because the data set is so large, the Event-Driven Stock Pattern Screener is currently limited to only those stocks with an average daily stock volume of over 50,000 shares.

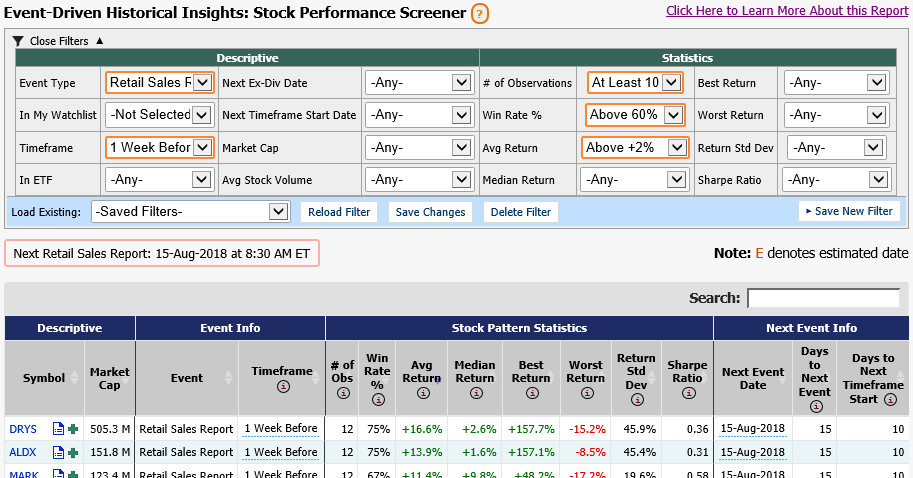

At the top of the page you'll see the Filters, most of which correspond to the result statistics in the table. The other filters are descriptive, like In My Watchlist, which selects only those symbols listed in your Custom Watchlists, or In ETF, which selects only those stocks which are currently listed as holdings in selected popular market ETFs (like SPY, DIA and QQQ).

Use Event Type to select the specific event you're looking to analyze, like Federal Reserve FOMC Meetings, Ex-Dividend Dates, or an exchange holiday. Then use Timeframe to narrow in on the relative timeframe, like 1 Week Before the event, or the Day of Opening Gap, or 2 Days After the event.

The Event Info columns show you the designated event type and the timeframe for this result. The Next Event Info columns show you the date of the next occurrence of the designated event, as well as the number of trading days until that date. Hovering over the Next Event Date column might show you some more information on the expected event. A date marked with an orange "E" is estimated -- we use this when we haven't received confirmation of the exact date or time.

The rest of the columns explain the result set, and can help you figure out the stocks that have had the best performance for the selected event type and timeframe.

Here's a screenshot of a sample result set from this screener: