A Debit Call Spread, also known as a Bull Call Spread or Long Call Spread, is a strategy that involves buying a call option at one strike and selling a call option at a higher strike (deeper out-of-the-money), both on the same expiration. The strategy requires an initial outlay of premium, because the lower strike call will have a higher cost than the higher strike call. It is one of the most common option spreads used by traders with a bullish outlook.

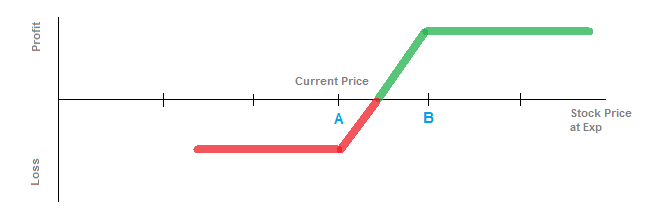

In the diagram above, you'd be buying a call at strike A (near at-the-money) and selling a call at strike B (out-of-the-money). There are many ways to structure the debit call spread, but you are using the sale of the higher strike to partially fund the purchase of the lower call to establish a bullish position.

If the stock price is currently $100, you buy a call on the $100 strike for $5, and you sell a call at the $105 strike for $2. The initial cost of the strategy is $3 ($5 - $2). In order for you to profit from the strategy, the stock price would have to move higher than $103, which is the long strike $100 plus the cost of the spread $3. Your maximum gain would be realized if the stock moves above the $105 strike. There, your call spread would be worth $5 and your cost was $3, netting you a profit of $2.

A debit call spread is a very common spread to use with a bullish outlook. You are expecting a move to the upside, but by selling the out-of-the-money call you are limiting the cost to put on a bullish position, and as a result your maximum gain is capped.

The break-even point is equal to the strike for the long call (strike A) plus the cost of the spread.

The maximum gain is capped at the value of the spread minus the initial cost. If the distance between your two strikes (strike A and strike B) is $5, and the cost is $3, then your max gain is $2.

Your maximum loss is the amount you paid for the spread. If the stock at expiration is at or below the long call strike (strike A), then both options would be worthless and you would lose the amount paid.