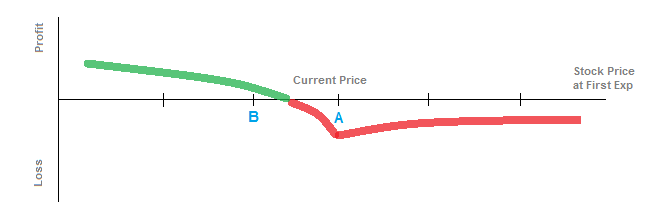

The Diagonal Put Spread is an advanced strategy for veteran traders that is a variation of a calendar spread or time spread. In this case, you'd be buying an at-the-money put (at strike A) in the near-term expiration and selling a put at a lower, out-of-the-money strike (strike B) in the far-term expiration. You should be trying to take advantage of inflated implied volatility and time value in the far-term expiration. Ideally, you could establish the strategy for a net credit at the time of the trade, but that would be dependent upon the strikes used and the cost of the options.

Assume a stock price of $100. You buy an at-the-money put for an option with 30 days to go until expiration for $3. Then, you sell a put on the $95 strike with 60 days to go until expiration for $5. You collect an initial premium of $2 on the trade. The goal would be for the stock price to dip lower, close to the $95 strike, and have the far-term implied volatility decrease. If the stock price at the time of the first expiration is $95, your long put would now be worth $5, and hopefully both the volatility and time value of the far-term option have decreased. Let's assume the value of the far-term option has remained the same, at $5, but your long put in the near-term is now worth $5, so you can sell it for a $2 profit (you bought it for $3 initially). You can buy back your short put in the far-term for $5 and break even, and now the strategy has turned a profit $2 in total (versus collecting $1 initially).

This strategy would be good if you feel that the stock price has a chance to drift slightly lower during the first expiration, and that the time value and implied volatility of the far-term option would decrease.

The break-even is dependend upon several variables, because the far-term option is still active at the time of the near-term expiration. You can approximate the break-even points based on time decay, implied volatility, and stock price movement, but choosing an exact break-even point is not an essential feature of this strategy.

The potential maximum gain is achieved if the stock price at expiration is near the lower strike (strike B), and your long option in the near-term gains value but the short option in the far-term loses time value and volatility.

The maximum loss is not easy to determine because the value of the short option in the far-term would be unknown when the near-term option expires.