A Double Bear Spread consists of 4 options on 4 different strikes for the same expiration. Essentially, you are trading 2 vertical bearish spreads at the same time in the same expiration. First, you buy an out-of-the-money put spread for a debit, and then you sell an out-of-the-money call spread for a credit. Your outlook on this spread is bearish, so it's similar to buying a bearish put spread, but you are selling an upside call spread in order to finance the purchase. The spread could be established for either a credit or a debit, but the amount is going to be relatively small in either direction.

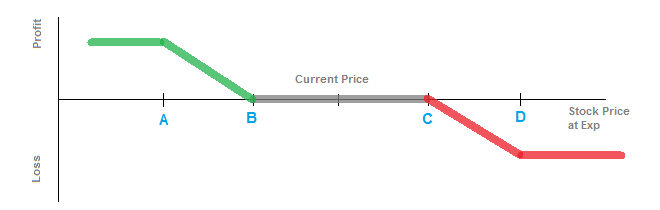

In the diagram above, you're selling a put on strike A and buying a put on strike B to establish the put spread. Then, you are selling a call on strike C and buying a call on strike D to establish the call spread. Usually, the distance between strike A and B is the same as the distance from strike C to D.

Assume a stock with current price of $100. You buy a $95 strike put for $4 and sell the $90 strike put for $3 (this debit put spread costs $1). Then, you sell the $105 strike call for $4 and buy the $110 strike call for $2 (selling the call spread nets you $2 in premium collected). The entire transaction is a net credit of $1. If the stock goes to $90 or below, you'd reach your maximum gain of $6 -- $5 from the value of the put spread, plus $1 from the initial credit. If the stock goes above $110, then you'd reach your maximum loss of $4 -- $5 loss from the value of the call spread, but $1 from the initial credit. If the stock at expiration is somewhere between $95 and $105, all the options expire without value, and you keep the $1.

This strategy is good if you have a bearish outlook and you don't want to spend very much (or want to take in a small credit) in order to establish the position. Because you are selling the call to the upside, your expectation would be that there is limited risk of the stock making a move higher. However, your risk is limited because you buy the far call, limiting your exposure.

If you establish the strategy for a net credit, the break-even point would be to the upside, and it would be equal to the short call strike (strike C) plus the amount of the initial credit.

If the strategy is for a net debit, then the break-even point would be to the downside, equal to the long put strike (strike B) plus the initial cost of the strategy.

The maximum gain on the strategy is capped, and is equal to the distance between the put strikes (strike A and strike B), plus any initial credit received from establishing the strategy. If the trade was for a net debit, then the max gain would be the distance between the strikes minus that cost. The max gain is achieved when the stock price goes below the lowest put strike (strike A).

The maximum loss on the strategy is limited to the difference between the call strikes (strike C and strike D), minus any initial credit received. If the strategy was established for a net debit, then the max loss is the difference between the strikes plus the initial cost. The max loss is experienced when the stock price reaches the highest call strike (strike D) or above.