Buying a long at-the-money (ATM) call is one of the simplest possible option strategies. It is used to establish a bullish position, with unlimited upside gains, similar to buying the stock. However, in many cases, buying an option is less expensive initially than buying the stock, and your downside risk is capped, unlike owning the stock.

If the stock price is $100, and you want to buy an at-the-money call on the $100 strike for $3, then the stock will have to go above $103 ($100 plus $3) for the trade to return a net gain. If the stock moves below $100, your maximum loss is capped at the amount you spent on the option.

A long at-the-money call is used when you want to establish a bullish position but don't want to buy shares of the stock, which could cost significantly more. As the stock moves above your break-even point, you will profit on a one-to-one ratio, but if the stock moves significantly to the downside, you could save yourself money versus buying the stock.

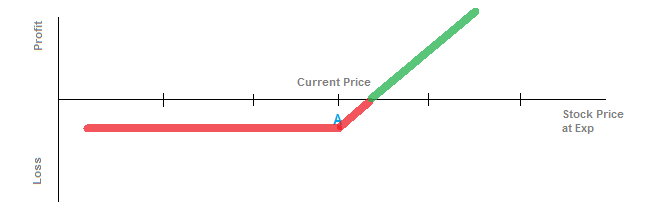

The break-even point is equal to the strike for the long call (strike A) plus the cost of the option.

The maximum gain is unlimited.

Your maximum loss is the amount paid for the option. If the stock is anywhere below strike A, you will lose the same amount of money.