Buying a long at-the-money (ATM) put is a very simple option strategy for a bearish position. Your gains are essentially unlimited, if the stock price drops all the way to $0, and your risk is capped at the amount you spend on the option. It can be a very helpful strategy if you think the stock is going to go down but you are unable to short the stock, or you are worried about what a significant gain to the upside could mean.

If the stock price is $100, and you want to buy an at-the-money put on the $100 strike for $3, then the stock will have to go below $97 ($100 minus $3) for the trade to return a net gain. If the stock moves above $100, your maximum loss is capped at the amount you spent on the option.

A long at-the-money put is used when you want to establish a bearish position but aren't able to borrow the stock for a short sale, or if you're worried about unlimited losses if the stock price suddenly goes up.

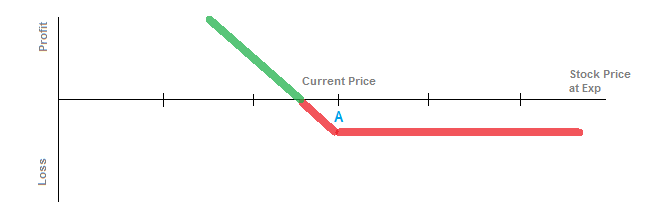

The break-even point is equal to the strike for the long put (strike A) minus the cost of the option.

The maximum gain is significant, but is theoretically limited to the amount of the strike price minus the cost of the option.

Your maximum loss is the amount paid for the option. If the stock is anywhere above strike A, you will lose the same amount of money.