The Ratio Call Spread, sometimes referred to as a Call Back Spread, involves 3 options on 2 separate strikes for the same expiration date. It is constructed by selling an at-the-money (ATM) call and buying two out-of-the-money (OTM) calls. In an ideal situation, you would want to be collecting premium at the time of the trade. To do that, you would need to ensure that the ATM call is worth at least twice as much as the OTM call.

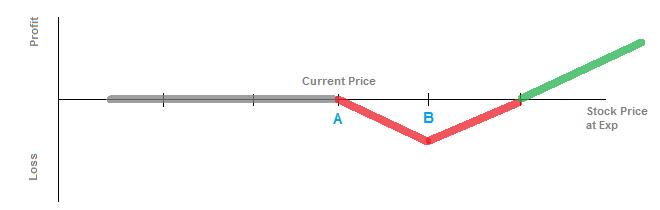

In the diagram above, you'd be selling the ATM call at strike A and buying two OTM calls at strike B.

Assume a stock with current price of $100. If you sell a call at the $100 strike for $5 and buy two out-of-the-money calls at the $105 strike for $2 each, you would collect a net credit of $1 for the trade ($5 sold - 2 × $2 purchased). If the stock at expiration is below the current ATM strike, then all options would expire worthless, and you'd be left with that net premium collected. The worst case scenario would be the stock expiring at $105. At that point, the two calls you are long will be worthless, but you will have to buy back your short call for $5, and you would have a net loss of $4 on the trade. If the stock reaches $109 or greater, you will begin to turn a net profit.

This would be a good spread to use if you are extremely bullish on the stock. However, if you can establish the trade for a net credit, it might be a good spread to use before a significant binary event, such as an earnings release or the results from a clinical trial. If the stock price drops dramatically, you'll just pocket the net premium from the sale. If the stock price has a significant gain to the upside, the strategy will turn profits. The downside to this strategy is when the stock price has modest gains.

If you can establish the spread for a net credit, the strategy will have two break-even points. If it is a net debit, the strategy only has one break-even point. To the upside, the break-even point would be equal to the at-the-money strike plus twice the distance between the ATM strike and the OTM strike, minus any net credit you received. (Or if the trade is for a debit, then it would be plus the initial cost.)

If the trade is for a net credit, then the lower break-even point would be the at-the-money strike plus the net premium collected. In the example we used above, this would be $101 (the $100 strike plus the $1 net credit).

The maximum gain on the strategy is unlimited. If the stock price takes off to the upside, you will profit at a one-to-one ratio beyond that break-even point.

The maximum loss is seen at the higher strike price. If the stock expires at that point, then the two long options will be worthless but the value of the short ATM call will be equal to the distance between the strikes.