The Ratio Put Spread, sometimes referred to as a Put Back Spread, involves 3 put options on 2 separate strikes for the same expiration date. It consists of selling an at-the-money (ATM) put and buying two out-of-the-money (OTM) puts at a lower strike. Ideally, you'd want to be able to collect premium at the time of the trade. To do that, the value of the ATM put would need to be at least twice the value of the OTM put.

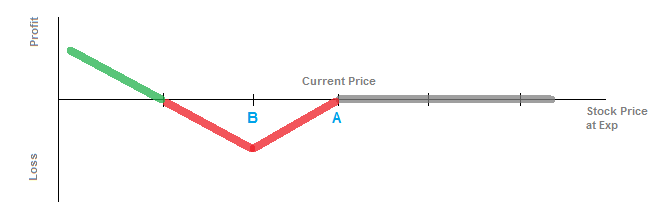

In the diagram above, you'd be selling the ATM put at strike A and buying two OTM puts at strike B.

Assume a stock with current price of $100. If you sell a put at the $100 strike for $5 and buy two out-of-the-money puts at the $95 strike for $2 each, you would collect a net credit of $1 for the trade ($5 sold - 2 × $2 purchased). If the stock price at expiration is above the current ATM strike, then all options would expire worthless, and you'd be left with that net premium collected. The worst case scenario would be the stock price at $95, at which point, the two long puts would be worthless, but you will have to buy back your short put for $5, resulting in a net loss of $4 on the trade. If the stock reaches $91 or below, you will begin to turn a net profit.

If you are extremely bearish on the stock, but are not expected a slight drop in stock price, this would be a good strategy. The value of the strategy changes if you are able to establish the spread for a net credit. If you can do that, the strategy would have extra value if the stock price moves to the upside, at which point you'd collect the premium and the options would expire worthless. It might be a good strategy for a significant news event, like earnings or an important company announcement, or for clinical trial results in a biotechnology stock.

If you can establish the spread for a net credit, the strategy would have two break-even points. Otherwise, there is only one. Far to the downside, there is a break-even point at the stock price that equals the ATM strike minus twice the distance between the ATM strike and the OTM strike, plus any net credit you received. (If the trade is for a debit, then it would be minus that initial cost.)

If the trade is for a net credit, then a higher break-even point would be the at-the-money strike minus the net premium collected. In the example we used above, this would be $99 (the $100 strike minus the $1 net credit).

The maximum gain on the strategy is equal to the far downside break-even point. In the example we used above, the downside break-even point is at $91. As the stock moves below $91, you will profit at a one-to-one ratio. So your maximum gain would be $91 if the stock price dropped all the way to $0.

The maximum loss is seen at the out-of-the-money strike price. If the stock expires at that point, then the two long options will be worthless but the value of the short ATM put will be equal to the distance between the strikes. So your max loss would be that distance, less any net credit received (or plus a net debit).