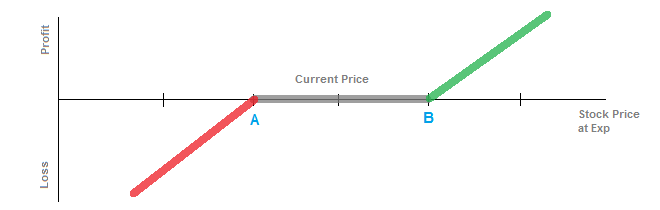

A Risk Reversal strategy involves buying an out-of-the-money call (at strike B in the diagram above) and selling an out-of-the-money put (strike A).

You want the stock to go above your long call strike as much as possible. You have unlimited profit potential to the upside, but you also have unlimited downside risk too. Generally, the advantage of a risk reversal is putting on a bullish position with a long call, but by spending very limited cash upfront because you are financing the purchase with the sale of a downside put.

You can also try to take advantage of the implied volatility skew with buying upside calls for relatively cheaper volatility than you'd be able to sell the downside puts.

If the stock price is currently $100, you would buy an upside call at the $105 strike and sell an out-of-the-money put at the $95 strike. The initial cost of the strategy would be very small, potentially even for a net credit. If the stock price at expiration is above the $105 strike, you'd begin to profit at a one-to-one ratio, because your downside put would be worthless. If the stock price goes below the $95 strike, though, you would begin to lose at the same ratio, because the call would now be worthless.

If you are very bullish on the stock, this would be a good strategy because of the limited cost to establish the position. It is a similar position to being long the stock, but at a much lower initial cost. You still have a large amount of downside risk, like you would have with buying a stock, but you are simply using options leverage to establish a bullish position. Ideally, the stock will skyrocket beyond the strike of your upside call.

The break-even point is dependent upon whether the strategy is established for a net credit or a net debit.

If it is a net credit, you will make money as long as the stock is anywhere above the downside put strike (strike A). You'd break even if the stock price dips below strike A by the amount of the initial premium collected.

If it is a net debit, then you would lose money unless the stock goes above the upside call strike (strike B). The break-even point would be at strike B plus the initial cost of the strategy.

You have unlimited profit potential to the upside.

You have nearly unlimited downside risk as well because you are short the put. If the stock drops to $0, you would lose the entire amount of the downside put strike.