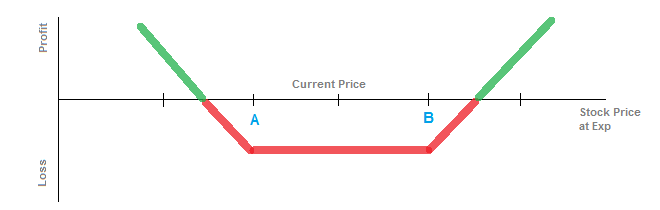

A long strangle consists of buying an out-of-the-money (OTM) call and an out-of-the-money put for the same expiration. Typically, the strikes are about equidistant from the current at-the-money spot price. In the diagram, you'll see a long put at strike A and a long call at strike B.

The strangle is similar to a Straddle in that you can gain on a stock movement in either direction. However, the difference is that the strangle has strikes spread wider apart. This means the initial cost of the strategy is lower, but it means the stock will have to make a larger move in either direction in order for you to profit.

Let's say the stock is currently $100 and you buy a call on the $105 strike for $2 and a put on the $95 strike for $1. Your total initial cost is $3, and you would need the stock to make a significant move by expiration in order for this strategy to profit. If the stock is anywhere between $95 and $105, then both options would be worthless and you would lose your initial cost. The stock would have to break through either strike by the amount of the strangle to profit from the strategy. Since you paid $3, if the stock goes below $92 or above $108, then you would return a profit. If the stock goes to $90, then your put would be worth $5, but your call is worthless, and since you paid $3 for the strangle, your net gain is $2. The same would be true if the stock goes to $110, but in that case, your put would be worthless, and the call would return a value.

You would look to use a strangle when you are expecting a significant move, either up or down. It could be around important binary events, like earnings releases, product announcements, investor meetings, or clinical trial results.

Additionally, if you felt the current implied volatility of the options is too low and you expect them to start rising, which would raise the premium of the options. This is often done by delta-neutral traders who are trading gamma.

There are 2 break-even points. The downside break-even is at the put strike (strike A) minus the cost of the strangle. So, in the example we laid out about, that would be $92 ($95 - $3). The upside break-even is at the call strike (strike B) plus the cost of the straddle. In the example, that would be $108.

The maximum gain is unlimited. If the stock price shoots above $105 and through the roof, your call would gain value at one-to-one ratio and your put would be worthless. If the stock price drops all the way to $0, your put could be worth as much as the strike price.

Your maximum loss is the amount you paid for the strangle. If the stock price at expiration is anywhere between the $95 strike and the $105 strike, you would lose all the premium you paid for the strategy.