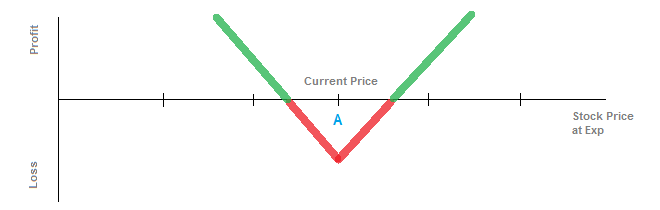

A long options straddle is when you buy a call option and a put option on the same strike for the same expiration. Typically, the strike will be the strike closest to the at-the-money price for that expiration. In the diagram above, you're buying both a call and a put on strike A.

Let's say the stock is currently $100 and you buy a call on the $100 strike for $3 and a put on the same $100 strike for $3 as well. Your total cost of the straddle is $6. In order for you to profit from the strategy, you want the stock price to move at least $6 from the current price, in either direction. Often times, the cost of the straddle will be expressed as a percentage. In this case, the straddle is 6% -- so you want the stock price to move by 6% either way.

If the stock goes to $102, for example, you will lose $4. The initial cost is $6, and your long call is now worth $2, but the put has no value, so your net is a loss of $4. The same would be true if the stock went down to $98, only with the put retaining value and the call expiring valueless.

A long straddle is a volatility play, and not dependent upon direction. If you think the stock price could go up a great amount, or could go down a great amount, then the straddle is right for you. Additionally, if you believe the current implied volatility is too low, then you could profit from an increase in volatility. An increase in volatility will make both call and put options more valuable, so if the volatility goes up, your straddle will increase in value.

Straddles are also popular around binary events like an earnings release, when the stock could have a significant move in either direction. Traders will typically look for straddles where the imlied volatility is low compared to the expected move driven by the event.

There are 2 break-even points. The downside break-even is at the strike minus the cost of the straddle. So, in the example we laid out about, that would be $94 ($100 - $6). The upside break-even is at the strike plus the cost of the straddle. In the example, that would be $106.

The maximum gain is unlimited. If the stock price shoots through the roof, your call would gain value at one-to-one ratio and your put would be worthless. If the stock price drops all the way to $0, your put could be worth as much as the strike price.

Your maximum loss is the amount you paid for the straddle. If the stock price at expiration is exactly the strike price you bought, then both your call and your put would be worthless and you would lost the initial premium paid.