An Iron Butterfly is made up of 4 options at 3 separate strikes. You can imagine it as selling an at-the-money put and call (selling a Straddle) to collect options premium, while buying an out-of-the-money put and an out-of-the-money call (buying a Strangle) to limit your risk in case the stock makes a signficant move in either direction.

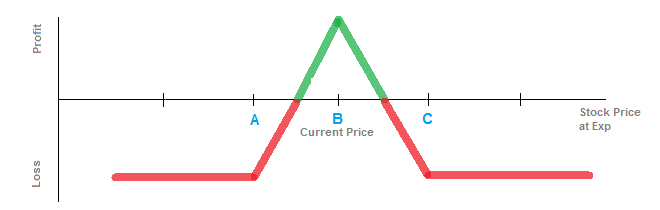

In the diagram above, you'd be selling an at-the-money (ATM) put and an at-the-money call at strike B, while buying an out-of-the-money (OTM) put at strike A and buying an out-of-the-money call at strike C. Strike A and strike C should be equidistant from the center strike B.

Let's split it up into two parts. If the stock is currently $100, and you sold the $100 strike put and the $100 strike call, you would collect a decent amount of option premium, but you would be exposed to unlimited upside risk and unlimited downside risk if the stock moves beyond the cost of the straddle. You can buy a call at the $105 strike to stop your risk to the upside, and you can buy a put at the $95 strike to stop your risk to the downside. Since those two options are out-of-the-money, the options will be worth less than the at-the-money options, and you will still be collecting premium at the time of the trade. It's effectively the same as selling an ATM credit put spread and selling an ATM credit call spread simultaneously.

A good time to use the Iron Butterfly strategy is when you're expecting very little stock price movement away from the current at-the-money strike (strike B above), but you want to limit your risk to a certain threshold.

This strategy has 2 separate break-even points. Since you're selling at-the-money options on strike B, the further away the stock moves from the strike price B, the more it will cost you to buy the option back. If you must buy it back for more than you initially sold it for, you would lose on the transaction. The break-even point to the upside is equal to the distance from strike B plus what you sold the strategy for (the initial premium collected). The break-even to the downside is equal to strike B minus the initial premium collected.

For example, if you sold the $95 - $100 - $105 iron butterfly for a $2 net premium, then your break-even points at expiration would be $98 and $102. To profit on the transaction, the price would have to remain between $98 and $102.

The maximum possible gain is the net credit you receive when initially selling the strategy. This would be achieved at the most optimal stock price equal to the strike price B at expiration. At that point, all of the options would expire worthless and you would keep all of the initial premium.

Your risk is limited to the distance between the center strike B and the outer strike A, less any credit you received for selling the strategy.

In the prior example, using $95 - $100 - $105 strikes, the distance between the outer strikes and the inner strike B is $5. We suggested the initial credit received was $2. Your maximum loss would be if the stock price at expiration was $95 or below, or if it was $105 or above. At that point, you would have to buy back the strategy for $5, and since you received $2 initially, your loss would be $3.