Buying a long out-of-the-money (OTM) put is a very simple option strategy. It is very similar to the Long Put ATM, but you're buying an out-of-the-money put instead, which will have a lower initial cost. As a result, however, the stock will have to make a larger move to the downside in order for you to profit.

If the stock price is $100, and you want to buy an at-the-money put on the $95 strike for $1, then the stock will have to go below $94 ($95 minus $1) for the trade to return a net gain. If the stock expires anywhere above $95, your maximum loss is capped at the amount you spent on the option.

Buying a long out-of-the-money put is a speculative bear play. You think the stock might have a huge drop to the downside, and you are willing to spend a small amount in case that drop happens. Alternatively, you might be buying a downside put as protection because you have a long position elsewhere.

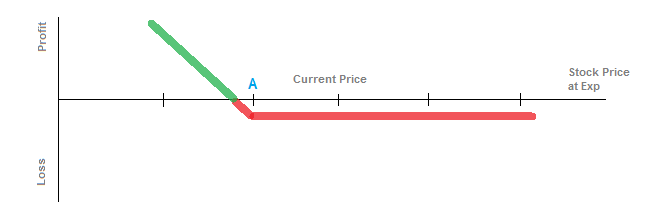

The break-even point is equal to the strike for the long put (strike A) minus the cost of the option.

The maximum gain is significant, but is theoretically limited to the strike price minus the cost of the option, if the stock drops to $0.

Your maximum loss is the amount paid for the option. If the stock is anywhere above strike A, you will lose the same amount of money.